Weekly Market Update – 2nd February 2026: Markets Mixed as Investors Digest Fed Meeting

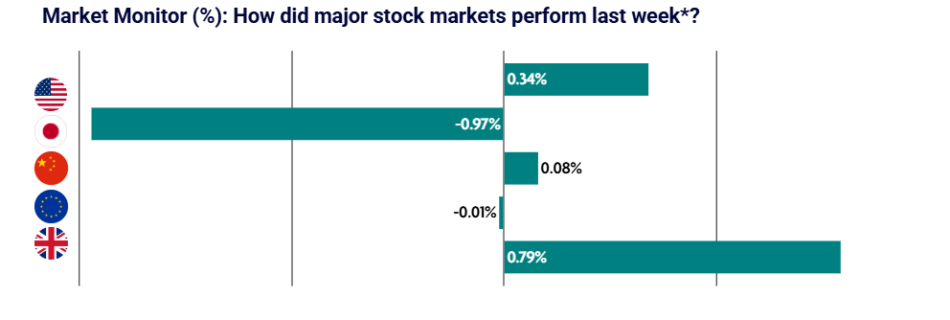

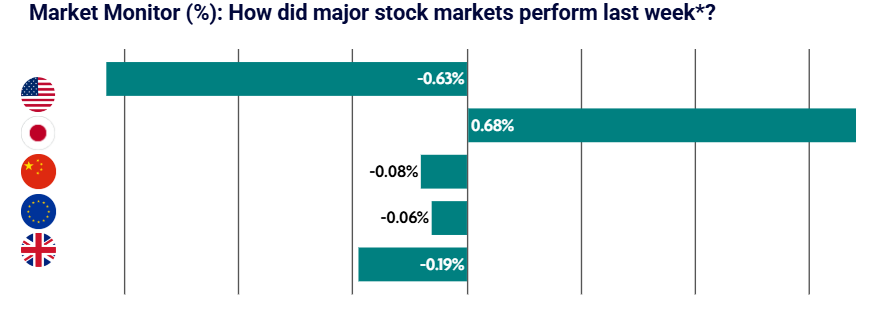

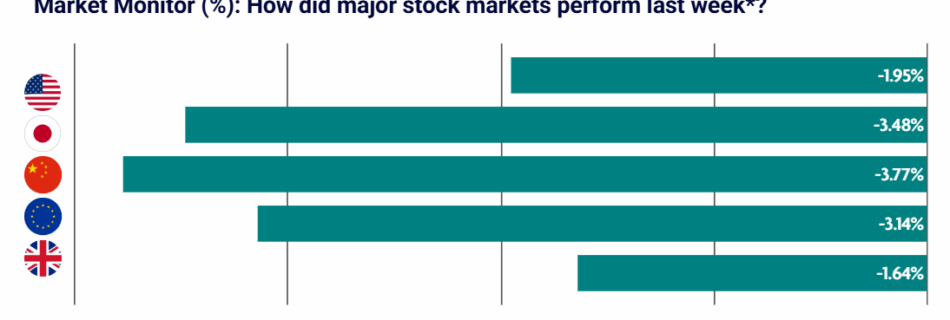

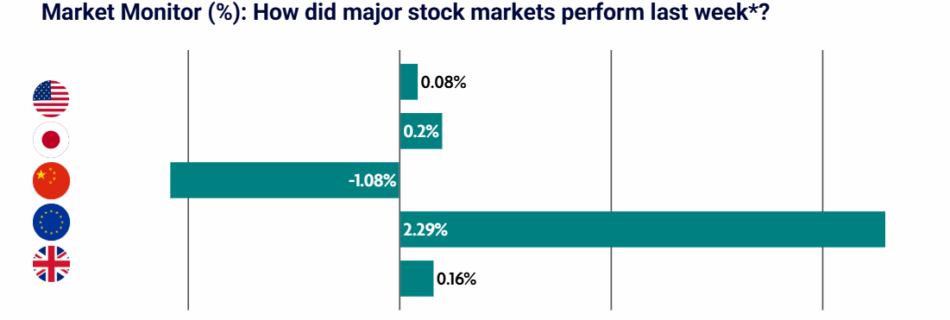

Global equity markets were mixed last week as investors reacted to the U.S. Federal Reserve’s latest policy meeting. UK equities were the standout performer, while Japanese markets lagged as a sharp rally in the yen weighed on sentiment. US: S&P 500 briefly touches record highs before pulling back on softening investor sentiment U.S. equities advanced …

Read more “Weekly Market Update – 2nd February 2026: Markets Mixed as Investors Digest Fed Meeting”