Weekly Market Update – 3rd Feb 2025: US Tech and Tariff Tensions

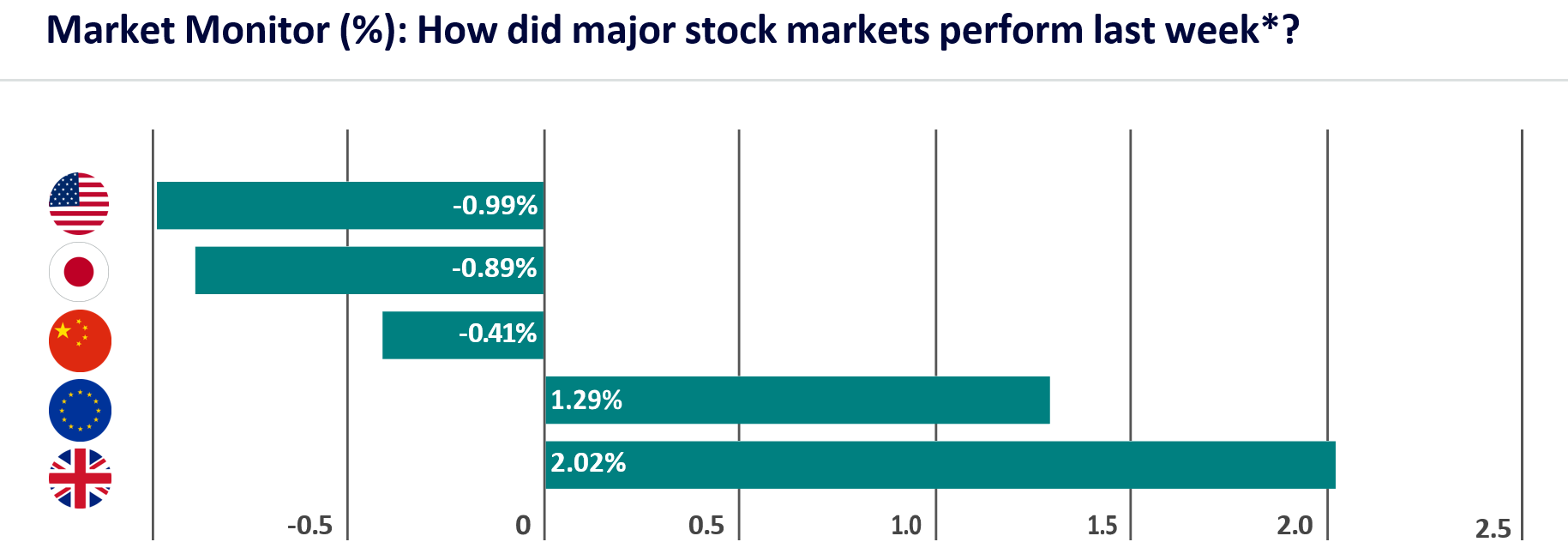

Last week’s performance – major stock markets

Main headlines from last week were centred around the US. In the US, tech stocks experienced weakness after a Chinese AI company, DeepSeek, disrupted the outlook for many AI names in the US. Alongside this, President Trump continued in his tariffs rhetoric, grabbing headlines.

Key stories from last week

U.S. stocks finished the volatile week 1% lower. The technology-oriented Nasdaq Composite Index experienced a particularly steep drop on Monday, driven by a sell-off in tech stocks in response to the emergence of DeepSeek, a Chinese artificial intelligence (AI) developer. DeepSeek released a new open-source large language model that reportedly requires much less energy and processing power than other leading AI applications, leading to competitive concerns in the broader AI space. The news led to shares of NVIDIA falling nearly 17% on Monday.

The second week of the Trump administration also brought a slew of political headlines that appeared to influence sentiment, particularly regarding the administration’s plans for global tariffs. President Donald Trump reiterated his plan to impose 25% tariffs on Mexico and Canada, the U.S.’s top two trading partners, by February 1, while also threatening to levy an additional 10% tariff on goods from China. This comes after the prior week’s comments from the president, which seemed to give investors hope that he would take a softer-than-anticipated stance on global tariffs.

This was something that was widely expected and the initial market reaction has not been severe. In a tariffs environment we would expect a stronger USD, stronger equities, and a mixed fixed income market. The fact that there have been retaliatory tariffs (and Trumps post saying that some pain will need to be felt) would highlight that the tariffs are probably going to be here for awhile and may be added to. He's already said that Europe is next. China looks like a relative winner, so far.

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

Content provided by Omnis Investments.

*Source: Bloomberg. All performance measured in local currency.

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.