Weekly Market Update – 8th September 2025: Markets Mixed as Growth Concerns Persist

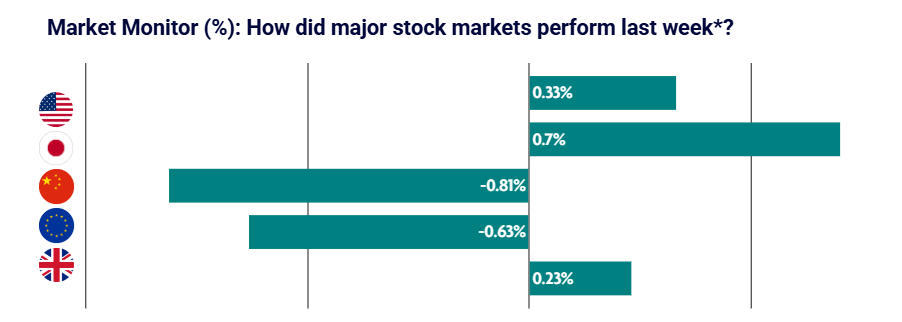

Markets were mixed during the week, balancing between expectations of interest rates moving forwards, the direction of travel for global growth, trade deals and profit-taking as markets continue to trade at near-time highs.

US: Stocks rise modestly on increasing likelihood of September interest rate cut

Stock indexes were generally up through Thursday and opened higher Friday morning following the release of some weaker-than-expected labour market data, which fuelled hopes that the Federal Reserve would lower short-term interest rates at its next meeting.

However, sentiment shifted later in the day and stocks gave back their early gains, due in part to fears that rate cuts may not be enough to boost economic growth.

The Nasdaq Composite finished the week 1.14% higher, supported by shares of Apple and Google parent Alphabet, which both rose in the wake of an antitrust ruling that some investors viewed as less severe than expected. Smaller-cap stocks, which can be more sensitive to interest rate movements than larger companies, also advanced for the week.

U.S. employers added just 22,000 jobs in August, a sharp decline from July’s revised figure of 79,000 and well below estimates for around 77,000. June’s figure was also revised down from a gain of 14,000 to a loss of 13,000, the first negative monthly reading since December 2020. August’s unemployment rate also ticked up to 4.3%, the highest since 2021.

Japan: Equities rally on implementation of trade deal with the U.S.

Japan’s stock markets rose over the week, with the Nikkei 225 Index gaining 0.70% and the broader TOPIX Index up 0.98%. Japanese auto shares were boosted by the U.S. officially implementing a trade deal with Japan reached in July, which caps tariffs on most Japanese goods, including autos, at 15%.

In exchange for lower tariffs, Japan agreed to investments of USD 550 billion in the U.S., as well as granting U.S. producers greater access to many of its markets, including for rice and other agricultural products.

The yield on the 10-year Japanese government bond hovered near 17-year highs midweek on political uncertainty, with Prime Minister Shigeru Ishiba facing calls to step down.

China: Profit taking by investors sees equity market rally lose steam

Mainland Chinese stock markets declined for the week as investors took profits after the recent rally. China’s stock markets have surged since April, largely due to domestic liquidity rather than strong corporate earnings or an improving economy.

The CSI 300 surged 10% in August, its best performance since a policy-driven rally last September. Optimism about China’s advances in artificial intelligence and a government-led “anti-involution” campaign to cut overcapacity and discourage price wars in various industries have fuelled sentiment.

Economic indicators have pointed to a broad slowdown in China’s economy, which is struggling with the threat of higher U.S. tariffs, a yearslong property downturn, and persistent deflation. Many economists believe that data in the coming months will confirm China’s growth slowdown and lead officials to roll out more stimulus to protect the economy amid the U.S.-sparked trade war.

Europe: Global growth concerns sees stocks under pressure

European equities fell for the week as the market grew concerned surrounding the global growth outlook. Major stock indexes were mixed. Italy’s FTSE MIB gave up 1.39%, France’s CAC 40 Index slipped 0.38%, and Germany’s DAX fell 1.28%.

Headline inflation in the eurozone ticked up in August to 2.1%, staying close to the European Central Bank’s (ECB’s) 2% medium-term inflation target. The core rate, which excludes food, energy, alcohol, and tobacco prices, was stable at 2.3%, as expected by analysts polled by FactSet.

Services price inflation—keenly watched by ECB decision-makers—slowed to 3.1% from 3.2% in July. Comments made by ECB policymakers reinforced the view that interest rates would remain unchanged in September and for some time after that.

UK: Outlook for near-term interest rate cuts becomes more clouded

UK equities delivered positive returns for the week, outperforming many of its European peers. UK banks and building societies in July approved 65,352 mortgages, exceeding forecasts.

However, house prices sent mixed signals. The Nationwide Building Society’s index unexpectedly fell in August by 0.1%, after rising 0.5% in July, while Halifax, another leading home loans provider, said prices rose 0.3% in August compared with 0.4% the previous month.

Bank of England (BoE) Governor Andrew Bailey warned at a hearing before a Parliamentary committee that there is “considerably more doubt” about further reductions in interest rates. He said that the risks of inflation going up had risen and that he was “more concerned” about labour market weakness.

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

Content provided by Omnis Investments.

*Source: Bloomberg. All performance measured in local currency.

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.