Weekly Market Update – 6th October 2025: Global Equities Rise on Strong Data and Earnings

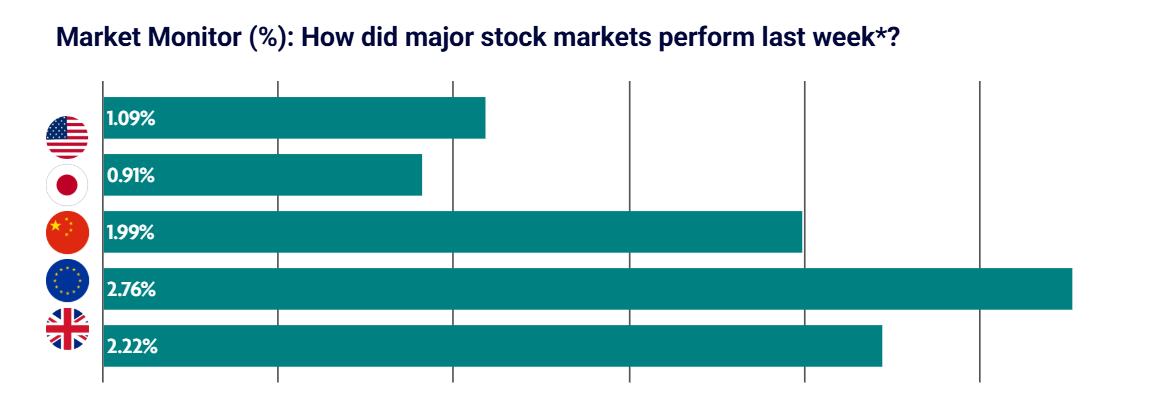

Major global stock indices rose modestly for the week, despite U.S. equities lagging on hawkish commentary from the Federal Reserve. Chinese equities performed best, as domestic investment continued to propel share prices higher.

US: Stocks ease on hawkish commentary from the Federal Reserve

Major U.S. stock indices finished the week lower, driven in part by hawkish commentary from Federal Reserve officials that dampened optimism around the pace of further interest rate cuts. Fed Chair Jerome Powell noted that the economy is in a “challenging situation” due to near-term upside inflation risks and downside labour market risks, while also acknowledging that “equity prices are fairly highly valued.”

The Nasdaq Composite fared worst, falling 0.65%, followed by the Russell 2000 Index, which registered its first weekly loss since early August. Inflation was little changed in August, with the core personal consumption expenditures (PCE) price index showing a 0.2% rise, in line with estimates and July’s revised reading.

Across both the manufacturing and services sectors, businesses’ expectations for output over the next 12 months improved to the highest level in four months.

Japan: Stocks rise as expectations for a near-term interest rate hike are tempered

Japan’s stock markets rose over the week, with the Nikkei 225 Index gaining 0.69% and the broader TOPIX Index up 1.25%. Expectations of a near-term interest rate hike by the Bank of Japan (BoJ) were tempered by a lower-than-expected Tokyo area consumer inflation print, while Japanese pharmaceuticals lagged after the latest U.S. tariff announcements targeted the sector.

Political uncertainty weighed on the yen, given a range of possible outcomes in the Liberal Democratic Party’s (LDP) presidential election. The Tokyo area consumer price index rose 2.5% year on year in September, steady from the prior month but short of economists’ forecasts of 2.8%. The softer inflation reading, largely due to temporary subsidies, eased near-term rate hike expectations.

China: Stocks climb in a quiet week for economic data

Mainland Chinese stock markets recorded a weekly gain. The onshore CSI 300 Index advanced 1.07% and the Shanghai Composite Index added 0.21% in local currency terms, according to FactSet.

No major economic indicators or corporate earnings were released during the week, leaving traders with little fresh data. Instead, strong domestic liquidity has fuelled market gains since April, with cash-rich households seeking higher returns amid low interest rates and limited alternatives.

Investor sentiment has also been boosted by breakthroughs in homegrown artificial intelligence startups and Beijing’s “anti-involution” campaign to curb excessive price competition across industries.

Europe: Business activity rises to highest level in 16 months in eurozone

Major European stock indices were firmer. Italy’s FTSE MIB gained 0.79%, Germany’s DAX rose 0.42%, and France’s CAC 40 Index added 0.22%.

The eurozone economy maintained a modest pace of growth in the third quarter, according to purchasing managers’ surveys. The HCOB Flash Eurozone Composite PMI Output Index rose to a 16-month high of 51.2 in September from 51.0 in August, with services activity driving growth while manufacturing expanded more slowly.

German business sentiment, however, fell sharply according to the Ifo Institute, while consumer confidence surveys from GfK and the Nuremberg Institute showed households were somewhat less pessimistic about their income prospects heading into October.

UK: Stocks rally despite consumer confidence falling to lowest level since June

The UK’s FTSE 100 Index rallied 0.74% over the week. However, PMI data fell to 51.0 from August’s 12-month high of 53.5. Activity in both the services and manufacturing sectors slowed, with output in the latter declining at the fastest rate since March, partly due to auto industry disruptions.

Business confidence also slipped to its lowest level since June, reflecting caution ahead of the November budget. Bank of England Chief Economist Huw Pill noted that reducing the pace of “quantitative tightening” would provide only temporary relief to gilt market turbulence, emphasising that other tools were better suited to addressing rising borrowing costs.

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

Content provided by Omnis Investments.

*Source: Bloomberg. All performance measured in local currency.

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.