Weekly Market Update – 27th May 2025: Global Markets Slip on Renewed Tariff Fears

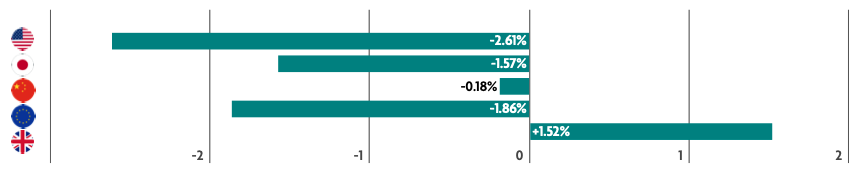

Global market returns were broadly negative last week as investor sentiment was impacted by renewed tariff fears from the Donald Trump administration. The first economic data releases since Trump’s first tariff announcement also provided a mixed view for each of the respective largest global economies.

US: Stocks fall amid Treasury market volatility and trump tariff threats

The US stock market closed lower over the week amid market volatility and renewed tariff threats. Volatility in the Treasury (US Government bonds) market was partially attributed to credit rating agency Moody’s downgrade of US sovereign debt at the end of the prior week due to concerns about rising US federal debt and fiscal deficits. Markets were also shaken after the House of Representatives passed Donald Trump’s tax bill, which some believe could increase federal debt markedly over the next few years. On Friday, tariff threats were reinvigorated after President Trump announced plans to impose a 50% tariff on imports from the European Union, effective June 1, stating that trade talks are “going nowhere”. The announcement also included a threat of 25% tariffs on iPhones unless Apple moves production to the US.

Japan: Inflation accelerates

Japan’s main stock market fell over the week as markets levelled up their expectations on further interest rate policy tightening by the Bank of Japan (BoJ) following recent elevated inflation data. While headline annual inflation remained unchanged at 3.6% in April, core inflation (which excludes the more volatile energy and food components) accelerated to 3.5%, marking the highest level in over 2 years. This reinforced the view that inflationary pressures are becoming more and more entrenched with expectations rising that the BoJ will increase interest rates to counter this.

China: data provides mixed picture of economy

Chinese stocks marginally fell over the week as investors shifted focus back to the economy after Beijing and Washington struck a temporary trade truce. A trio of economic indicators offered the first glimpse on the state of China’s economy following the rapid escalation of trade tensions with the US. Firstly, industrial output in April rose a better-than-expected 6.1% from a year prior. However, retail sales growth (a key consumption barometer) and fixed asset investment (property and infrastructure) both fell short of market estimates indicating that Beijing may need to roll out more spending incentives to boost consumer confidence.

Europe: Stocks down on renewed Tariff fears and weak business activity

European stocks ended the week lower after US President Donald Trump declared that he would recommend a 50% tariff on goods from the European Union. Further to this, on the economic data front business activity in the euro area unexpectedly contracted in May, as the service sector experienced a notable decline. The Eurozone Composite Purchasing Managers Index (PMI) fell to 49.5 from 50.4 in April. A reminder that the Composite PMI is a survey based on purchasing managers in various companies, which attempts to gauge the health of both the manufacturing and services sectors. A reading below 50 indicates that the economy is contracting. Elsewhere, the European Commission (EC) reduced its forecast for economic growth in 2025 to 0.9% from the 1.3% it had projected in late 2024. The downgrade was largely due to rising tariffs and uncertainty surrounding US trade policy.

UK: Economic data paints mixed picture

UK stocks ended the week marginally higher as data released during the week offered a mixed view on the economy. Firstly, higher utilities and housing prices boosted the UK’s annual inflation rate to 3.5% in April, marking the highest level since January 2024 and an increase from 2.6% in March. This came in higher than market expectations of 3.3%. Meanwhile, retail sales rose 1.2% in April from March and 5% on a year by year basis, coming in well above expectations. Consumer confidence also signalled improvement in May according to surveys from GfK and the British Retail Consortium. On a more negative note, the Office for National Statistics released figures that showed that productivity in the private sector in 2024 dropped below pre-Covid 19 and pre-financial crisis levels. This highlights the previous concerns raised by the Bank of England over the UK’s weak productivity performance, which as a result impacts policy decisions that influence economic growth and inflation.

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

Content provided by Omnis Investments.

*Source: Bloomberg. All performance measured in local currency.

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.