Weekly Market Update - 26th August 2025: Global Stocks React to Shifting Rate Expectations

Investor appetite for riskier assets globally was dampened by a pullback in the shares of U.S. mega-cap technology companies on concerns about the sustainability of the artificial intelligence-driven rally. Chinese equities on the other hand performed exceptionally well on easing geopolitical tensions with the U.S.

US: Soft week for equities reversed on Friday as near-term interest rate cuts put on the agenda

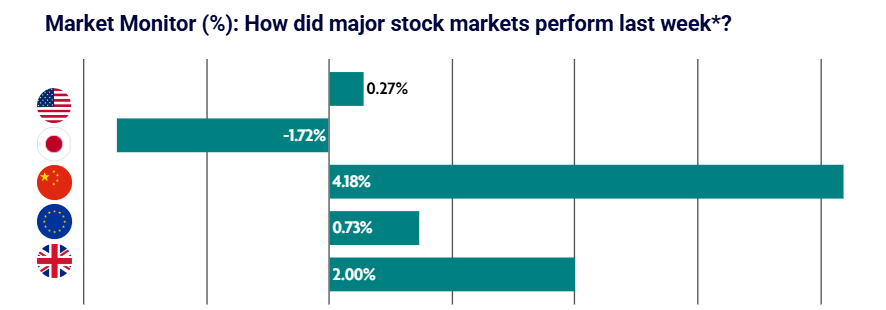

The S&P 500 Index rallied on Friday and ended modestly higher after losing ground for the first four days of the week. Federal Reserve Chair Jerome Powell’s remarks on Friday morning appeared to open the door to rate cuts, lifting investor sentiment. He acknowledged the difficulties posed by inflationary pressures and emerging weakness in the labour market in pursuing the central bank’s dual mandate of controlling inflation and maximizing employment. However, Powell asserted that the balance of risk appears to be shifting in ways that “may warrant adjusting [the central bank’s] policy stance”. An early reading of the S&P Global U.S. Purchasing Managers Index (PMI) indicated that business activity in August grew at the fastest pace so far this year. Large-cap value stocks outperformed their growth counterparts, which lost ground. The tech-heavy Nasdaq Composite finished the week lower, likely reflecting profit taking amid reemerging concerns about the sustainability of massive spending on infrastructure related to artificial intelligence.

JAPAN: Japanese equities ease on rising inflation

A hot inflation print reaffirmed investor expectations that the Bank of Japan (BoJ) could raise interest rates again this year, possibly as early as October. Japan’s core consumer price index (CPI) increased 3.1% year over year (y/y) in July, outpacing an expected 3.0% rise but easing from the 3.3% inflation rate recorded in June. While consumer price inflation remains well above the BoJ’s 2% target, the central bank has continued to reiterate that an accommodative stance is warranted because underlying inflation is still below target. Japan’s exports declined 2.6% y/y in July, as U.S. tariffs weighed on overseas demand. The decline was worse than a consensus forecasts. Weaker shipments of autos, auto parts, and chips to the U.S. were headwinds. Exports to China, the European Union, and the Association of Southeast Asian Nations also fell.

CHINA: Stocks rally on stabilisation in U.S. China trade tensions

Mainland Chinese stock markets recorded a weekly gain as a recent stabilization in U.S.-China trade ties spurred risk-on sentiment. The onshore benchmark CSI 300 Index rose 4.18% and closed at its highest level in a decade, while the Shanghai Composite Index advanced 3.49% in local currency terms, according to FactSet. In Hong Kong, the benchmark Hang Seng Index added 0.27%. Retail investors have driven the Chinese stock market’s recent rally as cash-rich households seek better returns amid low interest rates and a lack of compelling investment options in China. The amount of margin debt taken out to buy stocks climbed to its highest level since 2015 the prior week, according to Bloomberg, and is roughly 10% away from hitting a record high.

EUROPE: European stocks rise on hopes of lower U.S. borrowing costs

European equities were buoyed by hopes of lower U.S. borrowing costs. Most major stock indexes rose as well. Italy’s FTSE MIB gained 1.54%, while France’s CAC 40 Index added 0.58%. Germany’s DAX, on the other hand, was little changed. Business activity in the eurozone expanded for a third month running in August, as new orders rebounded after 14 months of declines. The eurozone Composite PMI Output Index rose to 51.1 from 50.9 in July, driven by manufacturing, which grew at the fastest rate in almost three-and-a-half years. (A PMI reading above 50.0 indicates expansion.) Germany posted a third successive increase in output, while activity in France shrank more slowly and showed signs of stabilizing.

UK: UK economy rebounds and labour market cools at slower pace

The UK’s FTSE 100 Index reached another record high, climbing 2.00% for the week. This was despite inflation accelerating to its highest level in a year and a half, driven by rising food and airfare costs. This has now left the gap with eurozone inflation at its widest level in 2 years. Services inflation, which is watched closely by the Bank of England, picked up to 5.0% from 4.7%. Business activity expanded the most since August 2024, led by a solid upturn in services. The Flash UK PMI Composite Output Index registered 53.0 in August, up from 51.5 in July. House prices in June rose 3.7% year over year from 2.7% in May, according to data from the Office for National Statistics.v

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

Content provided by Omnis Investments.

*Source: Bloomberg. All performance measured in local currency.

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.