Weekly Market Update - 24th February 2025: Mixed Global Trends

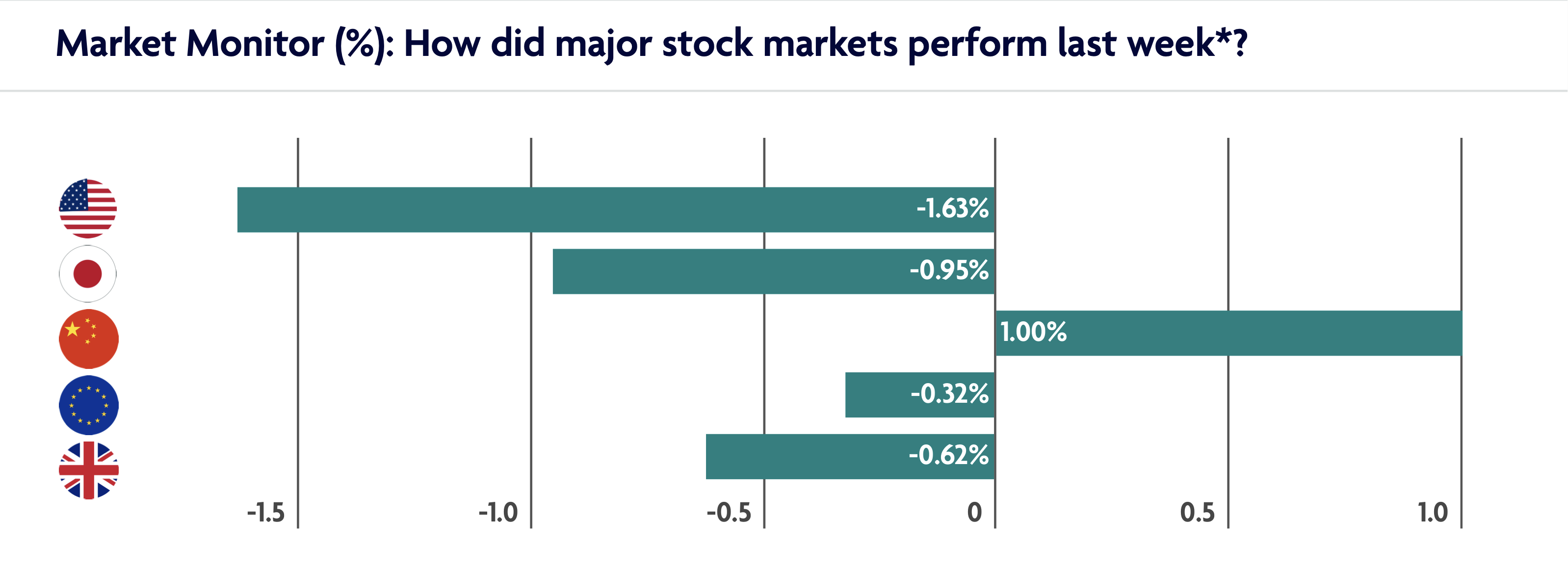

Last week’s performance – major stock markets

Weakness in the US retail sector, a surprise inflation report in the UK, and optimism in Chinese tech drove sentiment in markets last week. Read our update to learn more.

Key stories from last week

US stocks declined during the holiday-shortened week. With markets closed Monday in observance of Presidents’ Day, stocks started the week on Tuesday generally trending up, which led to the S&P 500 Index closing at record highs on Tuesday and Wednesday. However, sharp losses in the latter half of the week erased the early gains and led to the stocks finishing lower. Many of the week’s headlines centred around geopolitics and tariff news amid President Donald Trump’s efforts to end the Russia-Ukraine conflict as well as Trump’s announcement of his intent to impose additional tariffs on automobiles, pharmaceuticals, and lumber products, although details of the planned tariffs remained limited.

The negative shift in sentiment on Thursday appeared to be partially due to Walmart’s fourth-quarter earnings report, which was released Thursday morning. While the retailer posted consensus-topping results for the quarter, its guidance for the year ahead fell short, which seemed to drive broader investor concerns regarding consumer spending and the health of the overall economy. This came after the Commerce Department’s retail sales report from the prior week, which indicated retail sales dropped by the most in nearly two years in January. Shares of Walmart declined 6.53% on Thursday following the report.

In the UK, stocks were slightly down over the week. The latest UK inflation and wage data prompted financial markets to significantly reduce bets on three interest rate cuts by the Bank of England this year. Annual consumer price growth accelerated to 3% in January—the fastest rate since March 2024—from 2.5% in the previous month. Higher transport costs and rising food and non-alcoholic beverage prices drove the increase. Services inflation, which is closely monitored by policymakers, accelerated to 5.0% from 4.4%. Core inflation, which excludes volatile food and energy prices, picked up to 3.7% from 3.2%.

Meanwhile, in the three months through December, average wages, excluding bonuses, rose 5.9% annually, an uptick from the 5.6% increase logged in the previous quarter. Separately, the labour market was more resilient than thought. The jobless rate was stable at 4.4%, a level that was less than the 4.5% consensus forecast in a FactSet poll of economists.

Mainland Chinese stock markets rose for the week, lifted by strength in technology shares following better-than-expected earnings from some of the country’s leading tech companies. The surprisingly strong results from Alibaba and other Chinese tech companies came after local artificial intelligence startup DeepSeek showed off its technological capabilities in January, which renewed investor interest in the country’s internet sector. Sentiment was also buoyed after a high-profile meeting between President Xi and several Chinese tech entrepreneurs signalled that the government was adopting a more supportive stance toward private sector companies.

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

Content provided by Omnis Investments.

*Source: Bloomberg. All performance measured in local currency.

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.