Weekly Market Update - 24th March 2025: Fed Holds Steady Amid Growth and Inflation Revisions

Key stories from last week

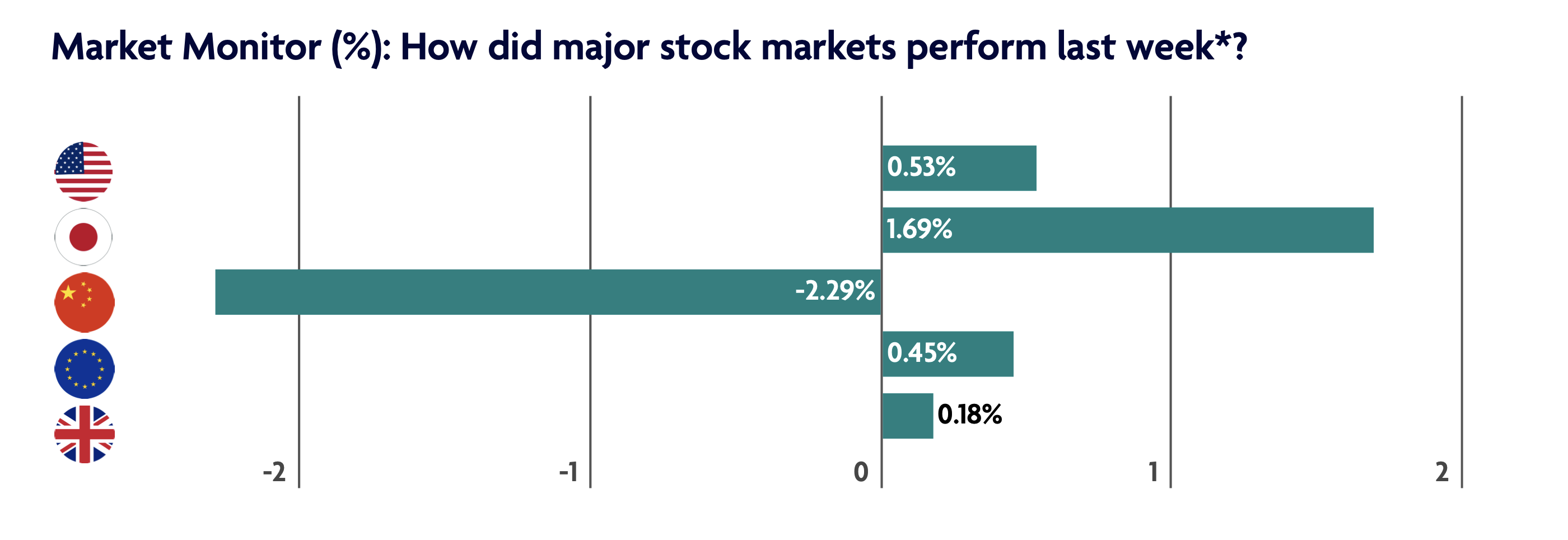

U.S. stocks closed the week higher. The highlight of the week’s economic calendar came on Wednesday as the Federal Reserve concluded its March monetary policy meeting. As was widely expected, the central bank held its policy rate steady at 4.25%–4.5%. Fed officials also indicated that they expect 50 basis points (0.5 percentage points) of rate cuts this year, unchanged from a previous projection in December. Notably, however, policymakers increased their expectations for inflation in 2025 while lowering their expectations for gross domestic product (GDP) growth. The Fed’s post-meeting statement also noted that “uncertainty around the economic outlook has increased.”

Nevertheless, takeaways from the meeting seemed to be largely positive, with Fed Chair Jerome Powell stating that the Fed’s “base case” is that the impact of tariffs will be transitory and that “most measures of longer-term expectations remain consistent with” the central bank’s 2% inflation target. Investors appeared to welcome the generally dovish tone following the meeting, with most stock indexes posting solid gains for the day.

In Europe stocks were slightly higher to broadly unchanged. The latest monetary policy statements highlighted trade-related uncertainty, with central bankers attempting to balance growth headwinds against the risk of faster inflation. Several policy announcements emphasized the cloudier economic outlook, with some central banks adopting a wait-and-see approach.

In the UK, stocks were moderately higher over the week. The Bank of England held interest rates at 4.5%, as expected. Only one of the nine rate setters voted for a reduction, which was seen as a hawkish signal by the market, which had anticipated a 7–2 split. Policymakers expressed concerns over high inflation expectations.

Mainland Chinese stock markets fell as investors turned cautious after two weeks of gains. China released a batch of better-than-expected indicators showing that the economy started the year on solid footing. Retail sales rose 4.0% in the January-February period from a year earlier, marking the quickest growth rate since November. Industrial output grew 5.9% year on year in the first two months of the year, slowing from December’s 6.2% expansion but still surpassing forecasts. Fixed asset investment—which includes property and infrastructure investment—increased 4.1% in the January-February period year on year, above expectations and December’s 3.2% pace. China’s statistics bureau combines data for January and February to smooth out distortions caused by the irregular timing of the Lunar New Year holiday. Other data signalled areas of weakness in the economy, however. Property development investment sank 9.8% in the first two months of 2025 year on year after falling 10.6% in December, according to the statistics bureau, indicating that China’s yearslong property slump has yet to bottom. The urban unemployment rate climbed to 5.4%, the highest level in two years, Reuters reported.

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

Content provided by Omnis Investments.

*Source: Bloomberg. All performance measured in local currency.

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.