Weekly Market Update – 22nd September 2025: Investors React to Global Monetary Policy

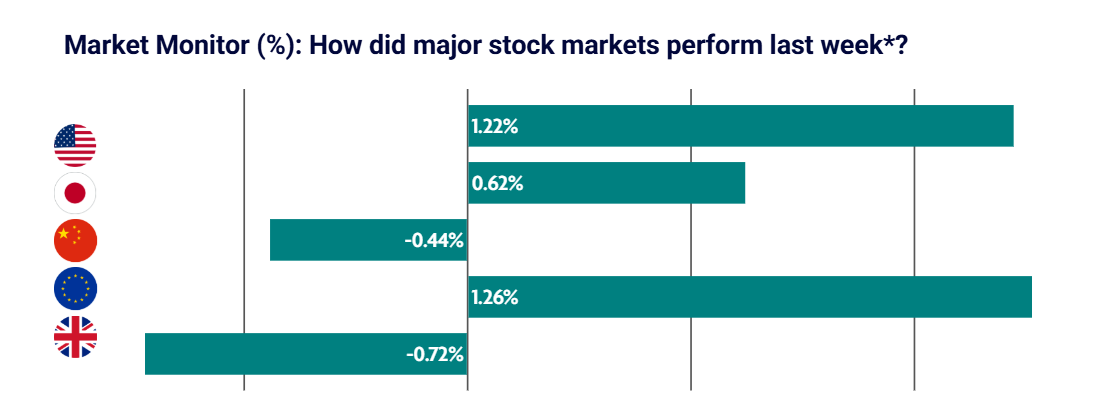

A mixed week for global equity markets as investors digested a raft of monetary policy decisions. US equities again reached record highs, while UK equities eased on the back of cautious commentary from the Bank of England.

US: Stocks rise to record highs on the back of 0.25 percentage point interest rate cut

Major U.S. stock indexes rose to record highs during the week, as the Federal Reserve lowered short-term interest rates for the first time in nine months. With the 0.25 percentage point rate cut in-line with expectations, investors’ attention quickly turned to signals from policymakers around the path forward for interest rates.

The Fed’s Summary of Economic Projections indicated that most policymakers expect to lower the central bank’s policy rate by an additional 50 basis points by the end of the year. Expectations for rate cuts in 2026 and 2027 also increased.

Trade developments were also in the headlines following a Friday morning call between U.S. President Donald Trump and Chinese President Xi Jinping. In a social media post following the call, Trump announced that they had reached an agreement regarding U.S. ownership of the short-form video platform TikTok and had made progress on several other issues.

Japan: Equities mixed on news that the Bank of Japan plans to sell ETF and REIT holdings

Japan’s stock markets registered mixed performance over the week, with the Nikkei 225 Index gaining 0.62% and the broader TOPIX Index falling 0.41%. The Bank of Japan (BoJ) surprised investors by announcing plans to begin selling its holdings of exchange-traded funds and Japanese real estate investment trusts much earlier than markets had anticipated – a move widely seen as a signal toward monetary policy normalisation.

As had been widely anticipated, the BoJ held interest rates steady at 0.50%, in an environment of domestic political and global trade uncertainty. However, for the first time during Governor Kazuo Ueda’s tenure, two policymakers dissented, preferring a rate hike over holding rates steady. The BoJ continued to assert that it will raise interest rates if the economy and prices develop in line with its forecasts.

China: Data pointing to an economic slowdown sees investors take profits

Mainland Chinese stock markets declined as investors pocketed gains after a recent rally and a trio of indicators pointed to an economic slowdown. August retail sales rose 3.4% and industrial output gained 5.2% year on year, China’s statistics bureau reported, marking the worst monthly performance for both gauges this year.

Fixed asset investment growth slowed to 0.5% in the year’s first eight months, the lowest reading for the period on record except for 2020, a pandemic year, according to Bloomberg. All three readings trailed expectations and pointed to a broad slowdown in China’s economy after it grew a surprisingly strong 5.3% in the year’s first half.

Europe: Mixed returns for European equities as investors assessed a raft of monetary policy decisions

Major stock indexes were mixed. France’s CAC 40 Index gained 0.36%, Germany’s DAX lost 0.25%, while Italy’s FTSE MIB pulled back 0.60%. Norway’s central bank reduced its key policy rate by 0.25% to 4.0% – the second rate cut this year. The Bank of England left interest rates on hold and decided to slow their bond-selling programme.

Industrial production in the euro bloc rebounded in July by a seasonally adjusted 0.3% sequentially, after shrinking 0.6% in June. Increased output of capital, durable, and non-durable goods, despite tariff-related uncertainty, more than offset a contraction in energy production.

UK: Equities ease as Bank of England leaves interest rate cuts on hold

The Bank of England’s (BoE) Monetary Policy Committee voted 7–2 to leave the key interest rate unchanged at 4%, as expected. Policymakers also decided to slow the annual pace at which the BoE sells bonds on its balance sheet to GBP 70 billion from GBP 100 billion, partly to minimise the impact of sales on the gilt market amid higher long-term bond yields.

BoE Governor Andrew Bailey said: “Although we expect inflation to return to our 2% target, we’re not out of the woods yet so any future cuts will need to be made gradually and carefully.”

The BoE’s decision to keep rates on hold came after economic data showed headline annual inflation stayed at 3.8% in August. Overall wage growth, which includes bonuses, rose to 4.7% in the three months through July – an increase from the 4.6% registered in the three months through June and well above the 3% level seen as consistent with the BoE’s inflation target.

Although the unemployment rate remained at 4.7% in the three months through July, tax records showed the number of payrolled employees dropped for a seventh consecutive month in August, according to a preliminary estimate.

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

Content provided by Omnis Investments.

*Source: Bloomberg. All performance measured in local currency.

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.