Weekly Market Update – 21 July 2025: US Stocks Hit Record Highs Amid Earnings Boost

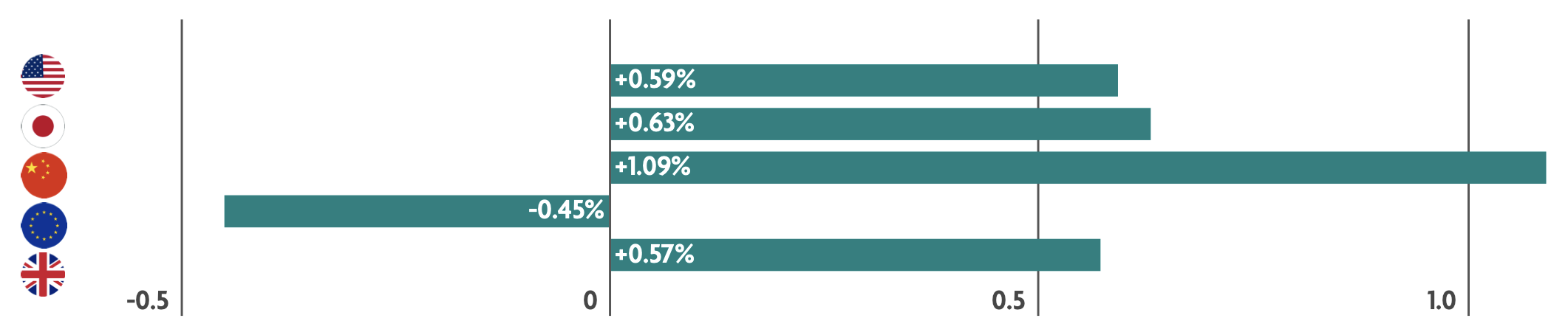

A muted week in markets with different drivers around the world. In the US, corporate results and a strong consumer help markets. In Japan, all eyes remain on politics. China’s economy remains robust, but challenges lie ahead. Investors keep a watchful eye on US-EU trade talks and in the UK, inflation unexpectedly rises.

US: Stock markets reach new records

Major stock market indices reached new records during the week, supported by solid corporate earnings reports and generally favourable economic data. Earnings season has begun with a positive tune – banks such as JPMorgan Chase and Citigroup reported better results than expected, as well as some consumer brands (e.g. Pepsico, Netflix) publishing better results than forecast. Stock investors also seemed to appreciate economic reports that pointed to consumer strength and inflation levels that, while not improving, didn’t seem too worrisome. Inflation increased in June with some economists pointing to higher tariffs as a driver of the price increases. And retail sales were up a better-than-expected 0.6% in June after falling in May.

Japan: Politics, inflation and trade

Japan’s stock markets registered modest gains over the week. Markets were faced by political uncertainty ahead of Japan’s Upper House election on 20th July, where a possible outcome could be that Prime Minister Shigeru Ishiba’s ruling Liberal Democratic Party-Komeito coalition fails to retain majority control. In other news, inflationary pressures appeared to be cooling as Japan’s core consumer price index (CPI) rose 3.3% year on year in June. Whilst still above central bank targets, it came in at lower than expectations due to falling contributions from energy, reflecting government subsidies. On the trade front U.S. tariffs weighed on foreign demand, with Japan’s exports falling again in June. Exports to the U.S. declined sharply due to weaker shipments of autos, auto parts, and pharmaceuticals, and sales to China also fell. The U.S. has announced that it will implement a 25% reciprocal tariff on Japanese imports, effective 1st August; however, trade talks between the two countries are ongoing.

China: Where next for the Chinese economy?

Mainland Chinese stock markets recorded a weekly gain. China’s economy grew 5.2% in the second quarter from a year ago, compared with the first quarter’s 5.4% growth pace. This higher-than-expected growth could ease pressure on Beijing to roll out further economic stimulus measures. However, there is some concern that economic growth could slow for the rest of 2025 amid worsening deflation pressures, weak retail sales growth, and the potential for a flareup in U.S. trade tensions once a temporary deal expires in mid-August. Persistent weakness in China’s housing market could also call for more stimulus from the central government.

Europe: Investors keep an eye on trade talks

Markets fell slightly as investors watched for signs of any progress in U.S. and European trade talks. In economic news, industrial production in the Euro area expanded in May, rebounding from the decline recorded in April and beating expectations. Increased output of energy, capital goods, and nondurable consumer goods drove the expansion. Meanwhile, German investor sentiment is at the highest point in three years, with investors expecting the economy to improve thanks to potential stimulus and expectations for a speedy resolution to the European Union’s trade dispute with the U.S.

UK: Inflation worse than expected

Contrary to European markets, the FTSE 100 Index rose during the week, helped partly by the depreciation of the UK pound against the U.S. dollar. A weaker pound lends support to companies in the FTSE 100 because many are multinationals that generate meaningful overseas revenue. In terms of economic data, inflation in the UK unexpectedly rose to 3.6% in June from 3.4% in May, the fastest pace since January 2024. Higher prices for transport, especially motor fuels, drove the increase. Services inflation - a key metric for the Bank of England - stayed at 4.7%. Meanwhile, the unemployment rate ticked higher in the three months through April, the highest level in four years.

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

Content provided by Omnis Investments.

*Source: Bloomberg. All performance measured in local currency.

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.