Weekly Market Update – 2 June 2025: Global Trade Policy in Focus

A more muted week for global markets, but with plenty of moving parts coming out of US trade policy. From an announcement regarding negotiations with the European Union and speculation regarding a US-Japan trade deal, to the ruling from the U.S. Court of International Trade and subsequent appeal – trade policy dominated investor sentiment during the week.

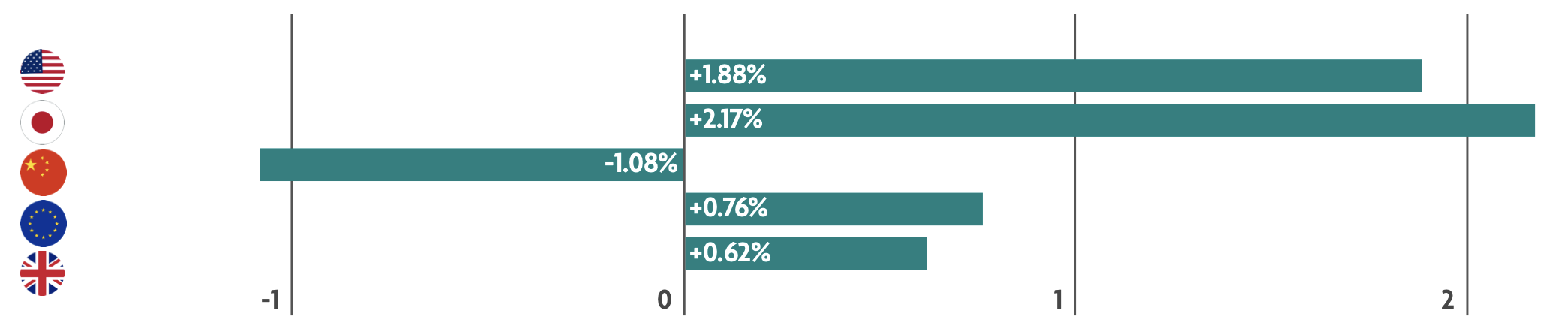

US: Stocks close higher as trade policy continues to dominate sentiment

Equity markets opened the week with strong gains following a weekend announcement from President Donald Trump that he would delay the introduction of a new 50% tariff on imports from the European Union until 9th July, and that negotiations between the trading partners would be “fast-tracked.” Later in the week, the U.S. Court of International Trade ruled that President Trump did not have the authority to impose the vast majority of the global tariffs that have been implemented since the start of his second term, sending stocks sharply higher on Thursday morning; however, the administration quickly appealed the ruling, and a federal appeals court put a temporary hold on the ruling Thursday evening, which led to stocks giving back some gains by the end of the week. Comments that U.S.-China trade talks were “a bit stalled,” as well as social media comments from President Trump suggesting that China had “violated” its preliminary agreement with the U.S., also seemed to dampen investor sentiment late in the week. In other news, the Federal Reserve’s preferred measure of inflation - the core personal consumption expenditures index - rose only 2.5% year over year in April, the lowest annual reading since 2021. While the April data appeared to show a promising trend, the reading remained solidly above the central bank’s long-term target of 2%, the full impact from tariffs is yet to be seen. Elsewhere, consumer confidence in May rebounded promisingly following the de-escalation of trade tensions.

Japan: Stocks rebound amid hopes of US trade agreement

Japanese Prime Minister Ishiba and US President Trump reportedly held a constructive telephone call on Thursday ahead of the fourth round of talks in Washington. This, together with Trump’s backing for Nippon Steel’s bid for U.S. Steel, fuelled speculation that both sides are paving the way for an accord by the time of the G7 meeting in mid-June, when both leaders plan to meet. In economic news, inflation in the Tokyo area rose 3.6% year over year in May - and the highest inflation rate in more than two years and slightly above economists’ expectations. Unemployment in April held steady as expected and industrial production fell but did so by less than anticipated.

China: Pause in the US-sparked trade war dampened investor sentiment

Mainland Chinese stock markets fell as a light economic calendar and a pause in the U.S.-sparked trade war dampened investor sentiment. After the pause in the tariff war that the U.S. and China negotiated earlier in May, Beijing has stepped up efforts to help shield its economy ahead of the expiration of the 90-day negotiation window in August. China plans to allocate roughly 70 billion US Dollars of capital to invest in new infrastructure projects. Investors viewed the pause as likely to result in less stimulus measures out of Beijing and this saw markets retreat.

Europe: European Central Bank set to cut rates this week?

Markets rose with after U.S. President Trump said he would give the European Union more time to negotiate a trade deal before 50% tariffs take effect. Slowing inflation in some major European economies also reinforced expectations that the European Central Bank (ECB) would cut interest rates. Inflation in Spain and Italy slowed in May, France showed some promising signs of inflation slowing and German has also seen some positive data in terms of inflation coming down. All eyes will be on the European Central Bank this week with most economists expecting another interest rate cut.

UK: Business sentiment weakens in UK services sector

Business confidence in the UK services sector - the largest part of the economy - fell to a two-and-a-half-year low in the three months through May after a hike in employment tax took effect and expectations for price increases grew. Investment intentions, business volumes, and hiring all cooled as well. Separately, data showed that car and commercial vehicle production in April fell 15.8% from a year earlier - the lowest for that month since 1952, excluding the decline during the coronavirus pandemic.

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

Content provided by Omnis Investments.

*Source: Bloomberg. All performance measured in local currency.

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.