Weekly Market Update – 19 May 2025: US Stocks Surge as Trade Tensions Ease

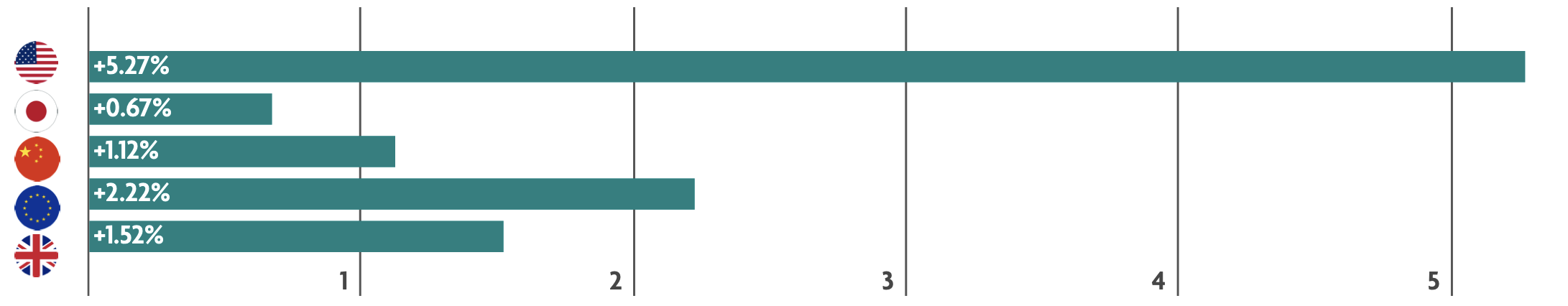

Global market reacted positively to a de-escalation in trade tensions between the US and China – with the US stock market posting some strong returns during the week. Investors remained concerned about the economic impact of tariffs and more muted returns from China appear to suggest that investors expect less stimulus from Beijing.

US: De-escalation of US-China trade tensions boosts markets

Positive investor sentiment was largely driven by news that the U.S. and China had agreed to a substantial de-escalation of trade tensions. The agreement between the world’s two largest economies will see most of their recently implemented tariffs suspended for 90 days while further trade negotiations continue, which will bring U.S. tariffs on most Chinese goods down from 145% to 30%, while China’s levies on U.S. imports will drop from 125% to 10%. Several other trade-related headlines—including news of an agreement that will allow Saudi Arabia to purchase large amounts of advanced artificial intelligence chips from U.S. companies—appeared to help fuel the positive move in stocks during the week. In other news, reports showed that during April, inflation in the US rose at the slowest annual pace since early 2021. Separate data shows that during April retail sales growth continued to decelerate and that consumer sentiment continues to slide.

Japan: markets up, but Japanese economic outlook remains concerning

The de-escalation in the U.S.-China trade dispute helped lift sentiment. Amid ongoing trade negotiations between Japan and the U.S., Japan continued to push for a review of all tariff measures imposed by the U.S., calling for a reassessment of duties on autos and other goods. Japan’s economy contracted by more than expected in the first quarter of 2025 and marked the first decline in a year, owed to sluggish private consumption, as well as concerns about the potential impacts of U.S. trade tensions and weak demand from Japan’s trading partners, notably China.

China: Trade talks and Economic support

Chinese stocks rallied early in the week after the outcome of tariff negotiations with the U.S. The deal with the U.S. exceeded expectations in China and ended up meeting nearly all of Beijing’s core demands. However, stocks pared their gains starting on Wednesday as a more favourable tariff outlook meant that investors are perhaps expecting less of a stimulus package from Beijing. Expectations that a trade war with the U.S. would spur the government to ramp up measures to boost the economy have driven positive investor sentiment in recent weeks. However, hopes for further government support have been tempered in the short term as the U.S. and China work toward a broader agreement over the next three months.

Europe: Strong economic data during March

Markets rose as investor sentiment improved after a de-escalation in the trade war between the U.S. and China. Looking at European economic data, industrial production in the euro area jumped in March, suggesting that the sector is emerging from a two-year recession. Strong increases in capital goods and durable consumer goods drove an expansion. Germany’s industrial output also increased. Furthermore, the eurozone’s trade surplus swelled in March, fuelled by a sharp rise in exports, particularly to the U.S. And employment rose in the first quarter of the year.

UK: Economy grows more than expected

Britain’s economy grew at a faster pace ahead of the imposition of U.S. tariffs on 2nd April. The economy expanded more than expected in the first quarter expanded and significantly more than in the final three months of 2024. Strong increases in services, investment, and exports drove the expansion. The Office for National Statistics reported that the unemployment rate rose a bit in the three months to March and the number of payrolled employees fell between February and April. Private sector wages, excluding bonuses—a gauge of underlying inflation pressure monitored by the Bank of England (BoE) rose in the January–March period, but did so with the smallest increase since the three months through November 2024. That said, the BoE Chief Economist said that inflation in Britain could prove stronger than the central bank expects and that interest rates might need to stay higher than investors think.

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

Content provided by Omnis Investments.

*Source: Bloomberg. All performance measured in local currency.

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.