Weekly Market Update – 18 August 2025: Markets Rally on Rate Cut Hopes

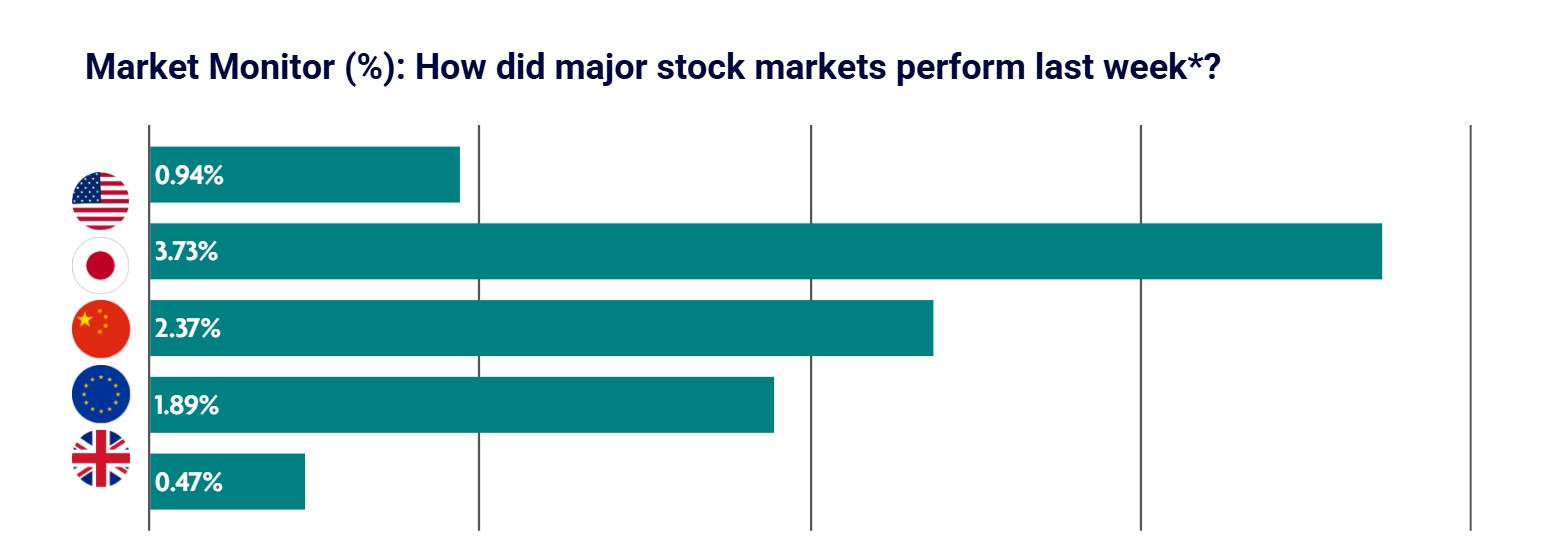

Favourable economic data and strong corporate earnings growth buoys global equity markets. Asian equities performed strongly, with Japan and China the standouts, rallying +3.73% and +2.37%, respectively.

US: Stocks rally on expectations of a September interest rate cut

U.S. equities finished the week higher, driven by favourable economic data that helped fuel bets that the Federal Reserve would lower interest rates in September. Tariff and trade news took a back seat to economic data and rate cut speculation for much of the week, although Monday brought news that the U.S. and China had agreed to extend the deadline for higher tariffs for another 90 days while a broader deal is negotiated. Equities were buoyed by the lack of a sharp, tariff-driven acceleration in inflation as a sign that the Federal Reserve will be able to reduce interest rates at its upcoming September meeting. The year-over-year inflation measure of 3.1% represents the highest level since February, with this largely driven by rising services costs, rather than tariff-impacted categories. Despite the equity market rally, consumer sentiment deteriorated driven by rising concerns about inflation.

Japan: Stocks cool on renewed global trade tensions and soft earnings announcements

Japan’s stock markets fell over the week, with the Nikkei 225 Index losing -1.58%. The Japanese technology segment was weak amid some unfavourable earnings developments, whilst renewed global trade tensions weighed on sentiment. The Bank of Japan left its key interest rate unchanged at 0.5% at its July 30–31 monetary policy meeting. In its quarterly outlook, the central bank revised up its expectations for inflation. The bank cited the evolving situation regarding trade and other policies in each jurisdiction as a key risk but acknowledged positive developments with the U.S. In economic data developments, Japan’s industrial production rose 1.7% month over month in June, outpacing market expectations of a 0.6% decline, following a 0.1% decline in May, whilst retail sales rose 2.0% year on year in June. The Bank of Japan continued to assert that if economic activity and prices develop in line with its forecasts, it will continue to raise interest rates.

China: Stocks rally on 90-day tariff deferral with the U.S.

Stocks rallied early in the week on news that recent negotiations with the U.S. resulted in an additional 90-day pause on higher tariffs, delaying a steep tariff hike that was set to take effect on Tuesday. The deadline extension seemed to give investors hope that trade relations between the world’s two largest economies will stabilize and ultimately lead to a broader agreement. On the economic data front, China’s statistics bureau reported that consumer price growth was flat year on year in July, dropping from June’s modest uptick that snapped a four-month streak of declines. Retail sales rose 3.7% year on year during the month, down from 4.8% in June and the slowest pace since December, while industrial output also slowed.

Europe: Equities rally on easing trade tensions & hopes for progress on the end of the Russia-Ukraine conflict

Equities in Europe performed strongly for the week driven by strong corporate earnings and hopes of a resolution of the Ukraine-Russia conflict. Italy’s FTSE MIB climbed 4.21%, Germany’s DAX gained 3.15%, and France’s CAC 40 Index added 2.61%. Strong retail sales and investor confidence data added to signs of a resilient eurozone economy in the second quarter. Retail sales expanded in June by 0.3% sequentially, increasing for three months running. However, they climbed 3.1% year over year, exceeding the consensus forecast of 2.0%. Investor confidence rose over the second quarter, although the mood soured in August, suggesting that businesses were unimpressed with the framework trade deal between the U.S. and the European Union.

UK: UK economy rebounds and labour market cools at slower pace

UK GDP expanded 0.4% sequentially in June after contracting by 0.1% in May. Surprisingly strong growth in services, industrial output, and construction drove the growth. Although GDP growth slowed in the second quarter to 0.3% from 0.7% in the first three months of the year—when businesses increased exports to the U.S. to avoid a rise in import tariffs—the rate of expansion still exceeded the Bank of England’s forecast of 0.1%. Meanwhile, fresh data indicated that the labor market weakened less than previously estimated. The number of payrolled employees fell for a sixth consecutive month in July, declining by a preliminary 8,000, while June’s decrease was revised to 26,000 from 41,000. The overall unemployment rate remained at 4.7%, the highest level since July 2021. Average weekly earnings including bonuses also slowed, rising by 4.6% year over year in the three months through June.

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

Content provided by Omnis Investments.

*Source: Bloomberg. All performance measured in local currency.

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.