Weekly Market Update – 17th March 2025: Markets React to Trade Policies and Economic Indicators

Key stories from last week

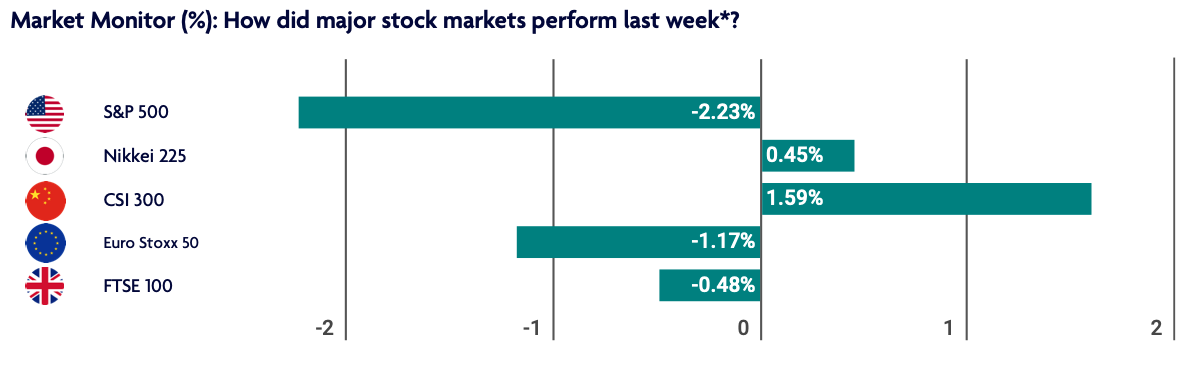

U.S. stocks posted losses for the week, with the S&P 500 Index, Nasdaq Composite, and Russell 2000 Index all notching a fourth consecutive week of negative returns. Ongoing uncertainty surrounding trade policy seemed to drive much of the negative sentiment as new tariff announcements from the Trump administration continued throughout the week. Growth concerns and increasing recession fears—which were amplified by comments from President Donald Trump regarding a “period of transition” for the U.S. economy—also weighed on sentiment during the week.

The week’s relatively light economic calendar was highlighted by Wednesday’s release of the Labor Department’s consumer price index (CPI), which indicated that consumer prices rose 0.2% month over month in February, while core CPI (less food and energy) saw its lowest year-over-year increase since April 2021, rising 3.1% over the prior 12 months. February’s readings for both monthly and annual inflation slowed from January, and both were slightly below consensus expectations. The encouraging inflation print seemed to help alleviate some concerns about the U.S. economy entering a period of stagflation—an economic scenario in which growth is stagnant, inflation is high, and unemployment rises; however, data from the report predate a large portion of the Trump administration’s recent tariff actions, and investors were quick to return their focus to the uncertainty surrounding the impact that these actions will have on prices over the next several months.

Days after the European Central Bank (ECB) decided to lower interest rates for a sixth time since June, comments from a clutch of policymakers appeared to cast doubt on another cut in April. “Exceptionally high uncertainty” could make it harder for the ECB to meet its 2% inflation target in the short term, ECB President Christine Lagarde suggested in a speech in Frankfurt

The UK economy unexpectedly shrank 0.1% in January, reflecting a fall in production. Gross domestic product (GDP) had expanded 0.4% sequentially the month before. Nevertheless, the rolling quarterly growth rate of 0.2% was higher than the 0.1% posted in December.

Mainland Chinese stock markets rose on stimulus hopes after Beijing said it would hold a press conference on Monday with policymakers focusing on boosting consumption. Officials from China’s finance ministry, commerce ministry, central bank, and financial markets watchdog are expected to appear at Monday’s briefing, which “will introduce the situation of boosting consumption,” according to the announcement from the State Council. News of the conference sparked a rally in Chinese shares on Friday, pushing the CSI 300 Index to its highest level since mid-December.

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

Content provided by Omnis Investments.

*Source: Bloomberg. All performance measured in local currency.

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.