Weekly Market Update – 16 June 2025: Geopolitical Tensions Shake Markets

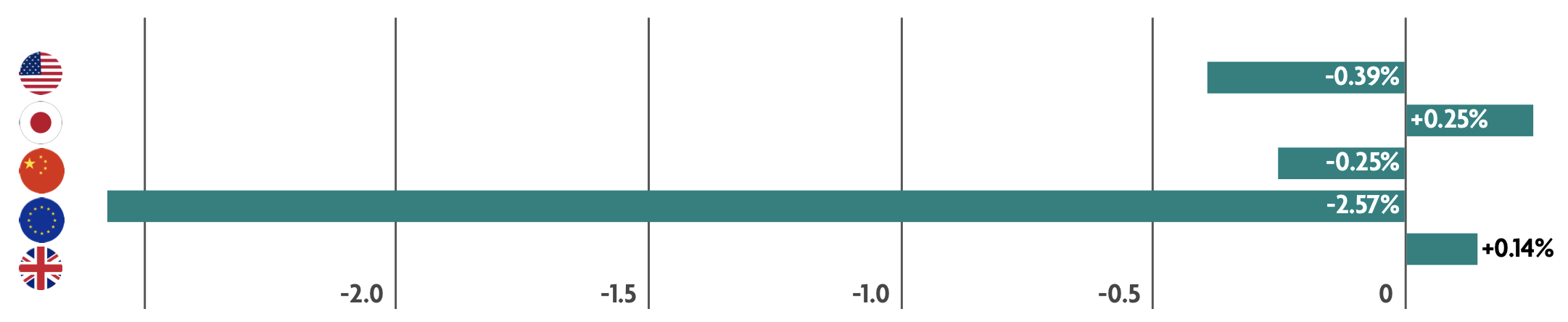

A week dominated by the escalation of geopolitical tensions in the Middle East, sending oil prices higher and markets lower. Other factors included developments in trade negotiations and a focus on economic news

US: Week starts with better-than-expected economic data but ends with geopolitical tensions rising

Markets were broadly up until Thursday, supported by some better-than-expected economic data releases, for example inflation appears to be cooling in the US. Markets were also positive due to reports that trade talks between the U.S. and China had led to a preliminary agreement to ease recent trade tensions. Several other optimistic trade-related headlines appeared to boost sentiment during the week, including comments that indicated the Trump administration’s 90-day pause on tariffs could be extended for countries negotiating in “good faith.” However, sentiment quickly turned negative on Friday morning on news that Israel had launched a series of airstrikes targeting Iran’s nuclear facilities and military leaders, with a pledge of more attacks to come. Iran reportedly responded with a retaliatory attack later that day. The significant escalation in tensions sent oil prices surging, benefiting energy stocks, while more broadly, markets fell sharply and gave back gains from earlier in the week.

Japan: Trade talks and geopolitics take centres stage

Stocks were mixed during the week amidst an escalation in geopolitical risk in the Middle East and an uptick in trade-related concerns. As investors sought assets perceived as safer, the Japanese yen strengthened against the U.S. dollar, weighing on the profit outlooks of Japan’s export-oriented industries. Investors remained focused on trade negotiations with the upcoming G7 summit viewed as potentially setting the stage for Japan and the U.S. to reach a trade agreement following two months of negotiations. On the economic front, revised figures showed that Japan’s economic growth was flat over the first quarter of 2025. Private consumption, which accounts for more than half of Japan’s economy, was slightly higher than anticipated, however, industrial production fell in April.

China: Deflationary pressures could weigh on economy?

Mainland Chinese stock markets declined as the latest inflation data underscored the deflationary pressures weighing on China’s economy. China’s consumer price index declined in May for the fourth straight month. Factory deflation continued for the 32nd month. Deflation is regarded as a fundamental economic challenge for China, where a multi-year property crisis has weakened domestic demand. Chinese stocks did however rise to their highest level for the week on Wednesday on news that officials from China and the U.S. agreed on a preliminary deal to reduce trade tensions following a two-day meeting in London. Details regarding the deal were scarce, however, and are pending approval from the respective leaders of both countries.

Europe: Will the European Central Bank (ECB) pause its interest rate cuts?

Markets fell sharply amid renewed uncertainty about U.S. trade policy and escalating geopolitical tensions in the Middle East. Beyond global events impacting markets, data showed that industrial output in the Eurozone struggled in April, and that the bloc’s trade surplus contracted much more than expected. Elsewhere, comments from the ECB made investors speculate that the central bank may pause cutting interest rates as they assess the economic impact of potential U.S. tariffs

UK: UK economy shrinks; labour market cools; pay growth slows

Markets behaved like their global counterparts, rising for the best part of the week, but dropping on Friday as tensions rose in the Middle East. Rising oil prices may have softened the blow, given the importance of energy companies in the UK stock market. In economic news, the UK economy shrank by 0.3% in April, following a period of growth in March. The decline was driven by downturns in services and production output. Exports of goods to the U.S. fell by £2 billion in April, the largest monthly decrease since records began in 1997. The labour market cooled further following increases in employer national insurance contributions and the minimum wage. Unemployment hit a four-year high of 4.6% in the three months through to April. Annual growth in private sector pay, excluding bonuses, which is closely monitored by the Bank of England as an indicator of inflation, rose by 5.2% over the period, the slowest pace since last summer.

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

Content provided by Omnis Investments.

*Source: Bloomberg. All performance measured in local currency.

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.