Weekly Market Update – 12th May 2025: Trade Talks Drive Market Mood

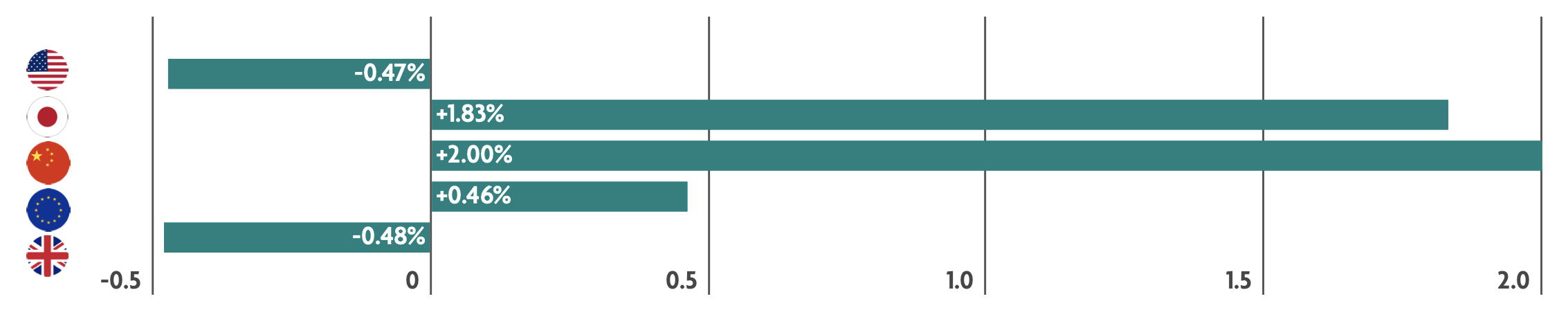

Global market returns were mixed but muted during the week. Trade talks continued to be a key focus area, with the UK-US trade deal boosting investor sentiment, as were the news that China and US were holding trade talks over the weekend. In China, an expected policy boost by the central bank also added to positive sentiment. Meanwhile, the Bank of England cut interest rates, as widely expected.

US: US-UK Trade agreement and Talks with China take the stage

US equities started the week lower but recovered somewhat on Wednesday following reports that U.S. and Chinese officials were planning to meet for trade discussions, potentially paving the way for broader negotiations and tariff de-escalation. Stocks continued to gain through Thursday, supported by the U.S. and UK’s announcement of the first new trade deal since the Trump administration’s reciprocal tariffs were unveiled, which helped fuel investors’ hopes of more deals to come. Over the weekend, the US claimed that substantial progress had been made after two days of trade talks with China. In other news, the US central bank (The Federal Reserve), kept interest rates unchanged. The central bank said that despite “economic activity continuing to expand at a solid pace, they cautioned that “uncertainty about the economic outlook has increased further” and “the risks of higher unemployment and higher inflation have risen.”

Japan: markets up, but Japanese economic outlook remains concerning

The yen weakened as the US dollar strengthened notably on the announcement of the U.S.-UK trade deal and confirmation by China that its trade negotiations with the U.S. were due to begin. However, there were limited signs of progress in the ongoing trade negotiations between the U.S. and Japan. The U.S. warned that a trade deal with Japan could take more time to complete than the framework agreement with the UK. Japan is urging the U.S. to review its series of tariff measures, seeking the full removal of reciprocal tariffs (President Trump imposed a 24% tariff on Japanese goods before the 90-day pause was announced) and the additional levies on specific items. The latest economic data raised some concerns about the outlook for Japan’s economy, which is already facing headwinds from tariff risks and their potential to delay the Bank of Japan’s actions on interest rates.

China: Trade talks and Economic support

Chinese stocks rallied early in the week on news that U.S. and Chinese officials would travel to Switzerland for trade talks. An unexpected policy boost by the central bank also added to positive sentiment. The measures reflected China’s increased efforts to protect the economy after the Trump administration said it would hike tariffs on most Chinese goods to 145%. On Friday, China reported that exports to other countries rose more than expected in April, whereas U.S.-bound shipments sank 21% from a year ago after Washington imposed the tariff hike in early April. Exports to India, Southeast Asian countries, and the European Union soared as Chinese companies offset the U.S. sales drop with sales to other markets.

Europe: Central banks stay put and industrial production gets a (temporary?) boost

Markets rose somewhat amid hopes for an easing in trade tensions between China and the U.S. Outside of the focus on tariff talks, Sweden’s central bank, kept its interest rate unchanged but highlighted there were more downside than upside risks since the March inflation forecast because of the uncertainty resulting from the new U.S. trade policy. The Norwegian central bank also left its interest rate unchanged maintaining a cautious approach as inflation remains above the 2% target. In economic news, German industrial production jumped in March, significantly exceeding forecasts. Manufacturers increased output ahead of the imposition of new U.S. tariffs and factory orders also went up.

UK: Bank of England cuts interest rates and UK-US Trade Deal

Three key news items came out of the UK. Firstly, the announcement of the UK-US trade deal. Secondly, the Bank of England cutting interest rates to 4.25%. This was widely expected, but the decision to cut interest rates was a close one with the central bank reiterating that a gradual and careful approach to future interest rate cuts remains appropriate. And finally, news that activity in the UK housing market slowed in April after the end of the tax break on home purchases for first-time buyers. In fact, the number of sales dropped the most since August 2023.

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

Content provided by Omnis Investments.

*Source: Bloomberg. All performance measured in local currency.

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.