Weekly Market Update – 11 August 2025: Global Equities Rebound on Strong Earnings

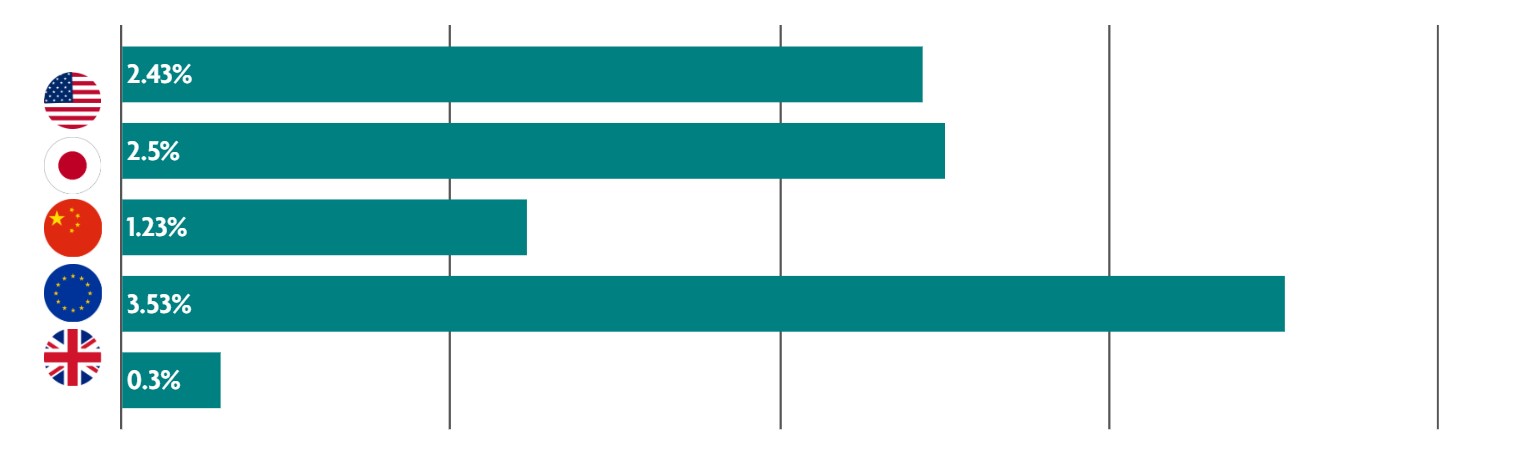

Global equity markets rebounded strongly for the week on improving economic data and strong corporate earnings. European equities were the highlight, rallying +3.53%, whilst the Nasdaq Composite Index closed at a new record high.

U.S. Equality Indexes advanced for the week, rebounding from the prior week's sell-off

The technology-heavy Nasdaq Composite performed best, closing the week at a record high, followed by the S&P 500 and Russell 2000 indices. Numerous stock-specific headlines helped drive market sentiment during the week. Notably, Apple announced that it would invest USD 100 billion developing U.S.-based manufacturing over the next four years, which would reportedly exempt the company from the Trump administration’s steep tariffs on semiconductors. In trade policy news, the Trump administration’s new round of global tariffs kicked in on Thursday, though several large U.S. trading partners had already reached agreements prior to the week’s deadline, and the market reaction appeared to be more muted compared with other recent tariff actions. Another area of focus was on the seemingly increasing likelihood of the Federal Reserve (the Fed) lowering interest rates at its next meeting in September. Several Fed officials made comments during the week suggesting rate cuts could be in the near future.

Japan: Stocks cool on renewed global trade tensions and soft earnings announcements

Japan’s stock markets fell over the week, with the Nikkei 225 Index losing -1.58%. The Japanese technology segment was weak amid some unfavourable earnings developments, whilst renewed global trade tensions weighed on sentiment. The Bank of Japan left its key interest rate unchanged at 0.5% at its July 30–31 monetary policy meeting. In its quarterly outlook, the central bank revised up its expectations for inflation. The bank cited the evolving situation regarding trade and other policies in each jurisdiction as a key risk but acknowledged positive developments with the U.S. In economic data developments, Japan’s industrial production rose 1.7% month over month in June, outpacing market expectations of a 0.6% decline, following a 0.1% decline in May, whilst retail sales rose 2.0% year on year in June. The Bank of Japan continued to assert that if economic activity and prices develop in line with its forecasts, it will continue to raise interest rates.

China: Stocks rally on improving economic data

Mainland Chinese stock markets rose for the week, aided by trade data underscoring the strong global demand for Chinese products despite the U.S.-sparked trade war. Total exports in July surged a larger-than-expected 7.2% from a year ago. Increased shipments to Europe, Southeast Asia, Australia, and other markets outweighed the continued slump in U.S.-bound shipments. The latest data showed that Chinese companies were able to compensate for the loss of U.S. business with increased sales to other markets. Earlier in the week, a private survey showed an unexpected uptick last month in services activity, possibly indicating a turnaround in weak consumer sentiment.

Europe: European stocks rally on strong corporate earnings

Equities in Europe performed strongly for the week driven by strong corporate earnings and hopes of a resolution of the Ukraine-Russia conflict. Italy’s FTSE MIB climbed 4.21%, Germany’s DAX gained 3.15%, and France’s CAC 40 Index added 2.61%. Strong retail sales and investor confidence data added to signs of a resilient eurozone economy in the second quarter. Retail sales expanded in June by 0.3% sequentially, increasing for three months running. However, they climbed 3.1% year over year, exceeding the consensus forecast of 2.0%. Investor confidence rose over the second quarter, although the mood soured in August, suggesting that businesses were unimpressed with the framework trade deal between the U.S. and the European Union.

UK: UK stocks rise, although gains lagged broader returns across Europe

The UK’s FTSE 100 Index added 0.30% for the week, lagging broader returns across Europe. The Bank of England (BoE) cut its key interest rate by a 0.25% points to 4%, reportedly on concerns about a weakening labour market. Governor Andrew Bailey said the decision was “finely balanced” and reiterated that “interest rates are still on a downward path, but any future rate cuts will need to be made gradually and carefully.” The BoE also forecast that inflation would accelerate to a two-year high of 4% in September, from 3.6% in August, and warned of a stronger risk of price increases in the coming years. The central bank is required to keep inflation at 2%—a target it has not achieved since last summer. UK employers are cutting back hiring in response to higher labour costs and the threat of further tax increases, fuelling concerns about the effects of government policies on the economy.

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

Content provided by Omnis Investments.

*Source: Bloomberg. All performance measured in local currency.

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.