Weekly Market Update - 10th March 2025: Markets Weaken Amid Tariff Uncertainty

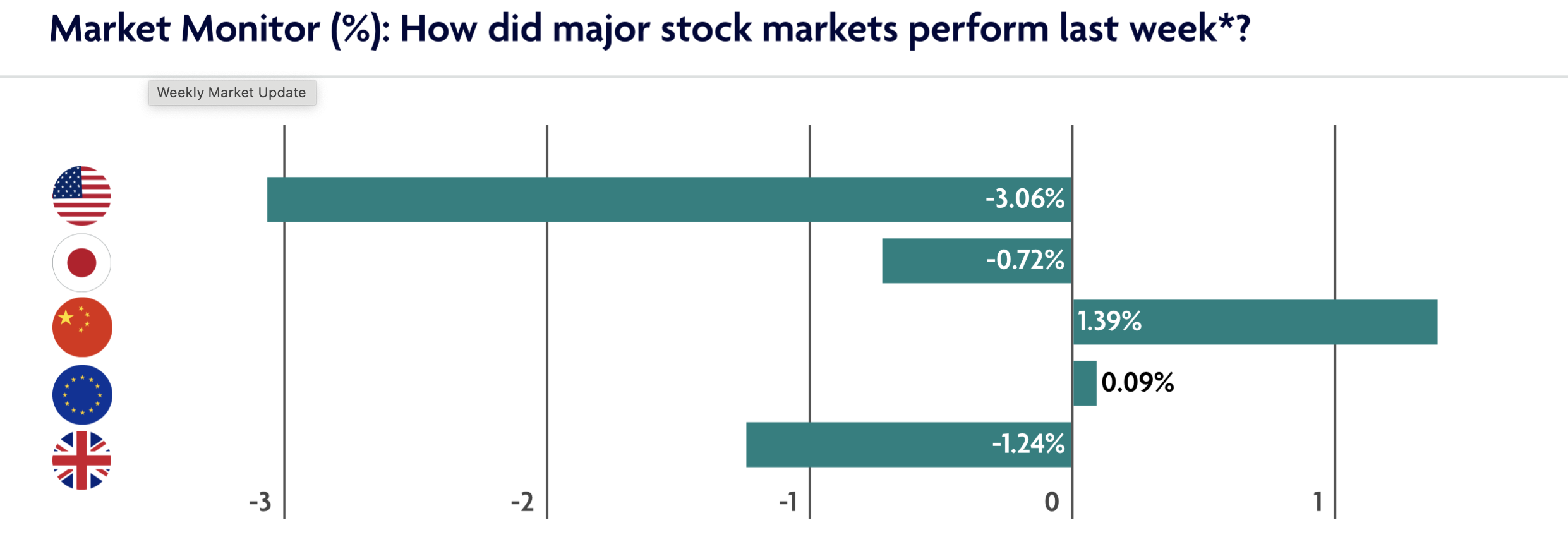

Weakness in global markets continued last week as Donald Trump and his plans for tariffs continued to concern markets.

Key stories from last week

U.S. stocks declined during what ended as the worst week for some major indexes since early September. Ongoing uncertainty around trade policy remained a focal point throughout the week as Tuesday marked the deadline for President Donald Trump’s previously announced tariffs of 25% on Canadian and Mexican imports along with an additional 10% on Chinese imports. The Trump administration announced a slew of exemptions and delays for the tariffs later in the week—including an announcement that goods covered by the U.S.-Mexico-Canada Agreement would be exempt for one month—however, the continued uncertainty and changing policies appeared to take a toll on investor sentiment during the week.

The week’s busy economic calendar kicked off on Monday with the Institute for Supply Management’s (ISM) manufacturing Purchasing Managers’ Index (PMI). According to the report, manufacturing activity expanded slightly in February. On Wednesday, the Federal Reserve released its Beige Book—a summary of economic conditions in each Fed region—which noted that “overall economic activity rose slightly since mid-January,” but “consumer spending was lower,” “price sensitivity” rose, and “prices increased moderately in most districts.” Tariffs were mentioned 49 times in the report, and most districts reported continued uncertainty regarding the potential impacts of the Trump administration’s new policies. The week’s economic calendar wrapped up on Friday with the Labor Department’s closely watched nonfarm payroll employment report. According to the report, the U.S. economy added 151,000 jobs in February, slightly below expectations but ahead of January’s reading of 125,000.

The European Central Bank (ECB) cut its key deposit rate by a quarter of a percentage point to 2.5%, as expected. ECB President Christine Lagarde said that rates were now “meaningfully less restrictive.” Touching on a potential trade war with the U.S. and other risks, she said: “We have huge uncertainty. Some people have used the adjective ‘phenomenal’ uncertainty.” This uncertainty already appears to be affecting investment and exports, prompting the ECB to lower its forecast for eurozone economic growth to 0.9% for 2025. The central bank also revised its projection for inflation to 2.3% for 2025, up from the 2.1% expected three months ago.

Mainland Chinese stock markets advanced for the week after Beijing unveiled economic growth targets in line with forecasts and signalled more stimulus later this year amid an escalating U.S. trade war. China unveiled several key targets at the recent National People’s Congress (NPC) meeting, an annual event in which the central government announces its economic priorities for the coming year. For 2025, China set a growth target of 5% for the third straight year.

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

Content provided by Omnis Investments.

*Source: Bloomberg. All performance measured in local currency.

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.