Weekly Market Update – 1st September 2025: Equities Ease as Fed Independence Questioned

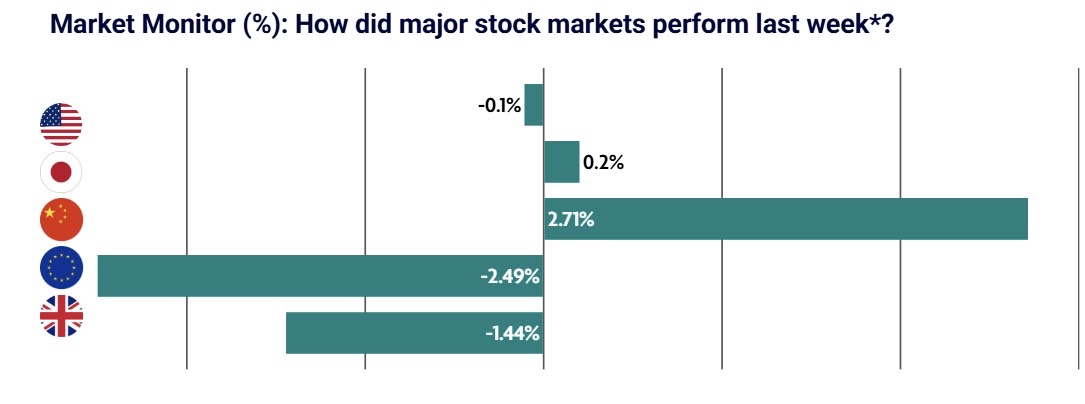

Global equities pulled back as concerns over U.S. Federal Reserve independence and wider geopolitical tensions weighed on sentiment. Chinese equities were the standout performer, rallying strongly once again.

US: Stocks ended the week modestly lower as markets headed into a holiday weekend

Small-cap stocks performed best, with the Russell 2000 Index posting moderate gains and outperforming the S&P 500 Index for the third week in a row. Much of the attention was focused on chipmaker, NVIDIA’s, earnings release after the market closed on Wednesday. NVIDIA posted earnings that were better than expected and while the stock pulled back, the numbers appeared strong enough to ease recent concerns around the artificial intelligence-driven rally. Concerns about the potential erosion of the Federal Reserve’s independence also garnered attention during the week following President Donald Trump’s announcement that he would be firing Fed Governor Lisa Cook, citing allegations that she committed mortgage fraud. Cook filed a lawsuit seeking to block the firing on Thursday, and a spokesperson for the Fed said the central bank will abide by any court decision. Inflation held steady month over month in July, according to the Bureau of Economic Analysis’s (BEA) core personal consumption expenditures (PCE) price index—which excludes food and energy costs and is the Fed’s preferred measure of inflation.

JAPAN: Profit taking by institutions saw stock performance as mixed

Japan’s stock markets ended the week mixed, with the Nikkei 225 Index gaining 0.20% and the broader TOPIX Index down 0.83%. Profit taking tied to month-end portfolio rebalancing by institutions that seemed to favour bonds more than equities was cited as a major reason, although equity markets also steadied ahead of a U.S. inflation report. In addition, trade talks with the U.S. were further delayed after chief trade negotiator Ryosei Akazawa cancelled a trip to Washington at the last minute, apparently due to unresolved issues that stand in the way of finalising an agreement.

CHINA: Strong domestic liquidity underpinned further equity market strength

Mainland Chinese stock markets advanced, extending the recent rally, with the onshore benchmark CSI 300 Index rising 2.71%. China’s stock markets have been on a tear in recent weeks. The CSI 300 gained almost 10% in August, ranking among the best-performing major indexes, and average daily turnover volume so far this month is on track for a record high, according to Bloomberg. Many analysts believe that ample domestic liquidity, rather than a strong economy, is fuelling the rally as cash-rich households in China seek higher returns amid low interest rates and a lack of compelling investment options. The amount of margin debt taken out to buy stocks climbed to its highest level since 2015, according to Bloomberg, suggesting elevated retail interest in the stock market. On the economics front, China reported that industrial profits fell a less-than-expected 1.5% in July, as strong tech sector earnings outweighed weakness in industries straining under weak demand and deflationary pressures.

EUROPE: European stocks pullback amid ongoing geopolitical instability

European equities fell for the week amid worries about the independence of the U.S. Federal Reserve. Renewed tariff uncertainty, political instability in France, and fading hopes of peace between Russia and Ukraine also weighed on sentiment. Major countries’ stock indexes fell as well. France’s CAC 40 Index dropped 3.33%, Italy’s FTSE MIB lost 2.57%, and Germany’s DAX declined 1.89%. European Central Bank (ECB) policymakers kept the deposit facility rate at 2.0% in July but were split over the outlook for inflation. Several rate setters argued that risks were tilted to the downside at least for the next two years, citing weaker growth prospects, the impact of U.S. tariffs, and a strong euro. A few members warned that inflation risks could still be tilted to the upside, especially over the longer term, given uncertainties around energy prices and currency movements.

UK: Equities ease from all-time highs on the back of share price weakness in the banking sector

UK equities slid for the week, largely driven by selling in the banking sector. This was on the back of the Institute for Public Policy Research recommending a new tax on lenders. NatWest and Lloyds fell -4.8% and -3.4%, respectively, while Barclays pulled back -2.2%. Retail sales volumes weakened for an 11th consecutive month in August. Meanwhile, shops raised prices by the most since the end of 2023, according to the Confederation of British Industry distributive trades survey.

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

Content provided by Omnis Investments.

*Source: Bloomberg. All performance measured in local currency.

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.