Markets Bounce Back: a timely reminder to stay invested

Following a US-China tariff truce, markets surged in May 2025. Discover why maintaining your investment strategy during volatility is crucial.

Stock markets had a difficult April after the US introduced sweeping new tariffs on global imports, triggering fears of a full-blown trade war. The announcement, dubbed ‘Liberation Day’ by the White House, included a baseline 10% tariff on all goods and much steeper “reciprocal” rates for key trading partners, including 145% on Chinese goods, 24% on imports from Japan and 20% on EU exports.

The reaction was swift. Share prices tumbled worldwide as investors worried about rising inflation, slower growth and disruptions to global supply chains. But in a dramatic turnaround, confidence returned in mid-May as the US and China announced a pause in their tit-for-tat trade escalation.

On Monday 12 May, the S&P 500 – a key index of large US companies – recorded its biggest one-day gain of the year, rising more than 3.2%. European markets followed suit, with the STOXX Europe 600 index climbing 2.5%, while Hong Kong’s Hang Seng Index rose 3%, reflecting a broader improvement in global investor sentiment.

Why markets welcomed the tariff deal

The catalyst for the rebound was a weekend deal between the US and China that many hope marks a turning point in their trade relationship. Both sides agreed to reduce some of the most damaging tariffs and suspend others for 90 days, giving room for further talks.

The US is cutting its reciprocal tariffs to 30%, while China is dropping its retaliatory tariffs from 125% to 10%. Additional non-tariff barriers are also being removed, and while some levies remain – including US tariffs aimed at tackling the fentanyl trade – the announcement was seen as a de-escalation.

Investors welcomed the move, not just for its economic implications, but also because it suggested both sides are seeking a more constructive path forward.

The announcement of a new UK–US trade agreement was also initially welcomed by markets, offering a sign of ongoing diplomatic engagement. However, while symbolically important, the deal is not expected to have a meaningful impact on broader market dynamics or global trade flows.

The risk of missing the rebound

Episodes like this show how quickly momentum can build in financial markets. After a period of gradual recovery, confidence surged, and the rebound on 12 May was one of the strongest in recent history. These sharp upswings are almost impossible to predict, and can often happen very quickly after sharp falls. That is why stepping out of the market during periods of uncertainty can mean missing the moments when performance turns around.

As Omins Chief Investment Officer, Andrew Summers, puts it: “Trying to time the market is risky – staying invested gives you the best chance of benefiting from the recovery.”

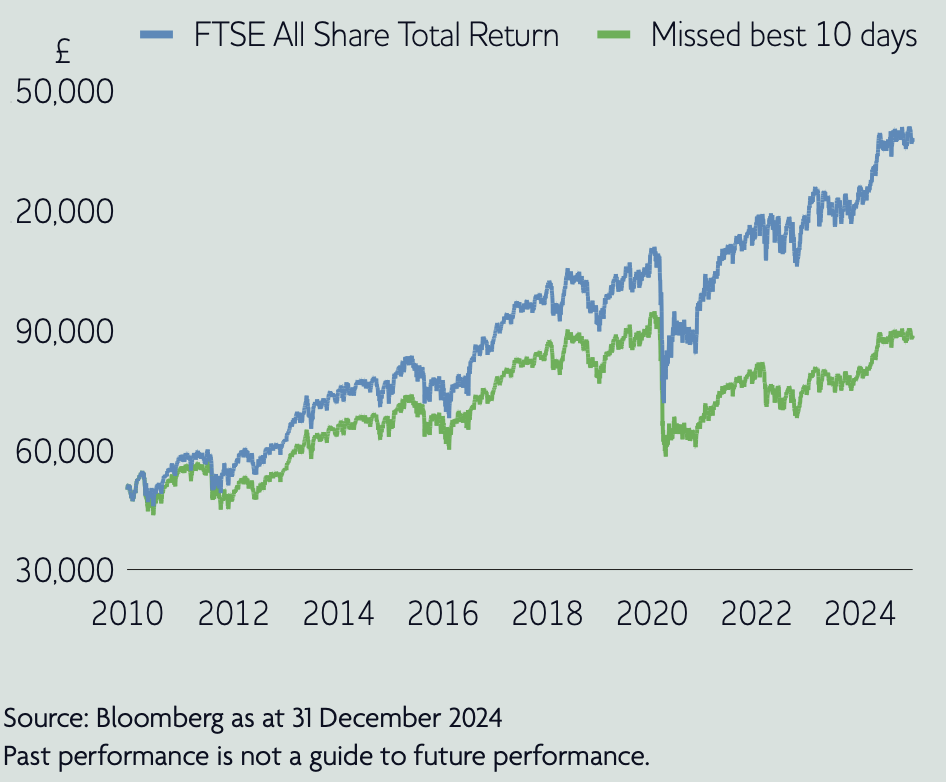

History shows that missing just a handful of the best-performing days can have a significant impact on long-term returns. It’s why we continue to emphasise the importance of staying invested, even when the headlines are unsettling.

Why just a few good days can hurt returns

This chart shows what happened to a £50,000 investment in the FTSE All Share index between January 2010 and December 2024. If you stayed fully invested, your investment would have risen to more than £138,000. However, missing just the 10 best days cut that return to less than £89,000, a difference of almost £50,000.

The message is clear – markets can turn quickly, and the best days often come during periods of uncertainty. Staying invested gives you the best chance of benefiting when the rebound comes.

What this means for your portfolio

While the tariff pause is good news, the outlook remains uncertain. Many of the changes are temporary, and economic data may continue to show mixed signals over the coming months. In this kind of environment, discipline and diversification are key.

Some regions, like the UK, have held up better than others, helped by more modest tariff levels and exposure to domestic-facing companies.Meanwhile, areas like Japan and Europe have felt more pressure, especially in export-heavy sectors like autos and industrials.

“Periods of underperformance can be uncomfortable,” says Hannah Evans, Head of Manager Research at Omnis. “But they often lead to stronger results over time. It pays to be patient.”

The value of your investment (and any income from it) can fall as well as rise and you may get back less than the amount invested.

Talk to your adviser

Market swings can feel unsettling. But they also reinforce an important truth – recoveries often come when they’re least expected. That’s why it’s so important to stay focused on your long-term goals.

Now could be a good time to speak to your financial adviser. They can help you ensure your investments are aligned with your circumstances, time horizon and stage of life, whether you’re growing your wealth or using it to generate income in retirement

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

Content provided by Omnis Investments.

*Source: Bloomberg. All performance measured in local currency.

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.