February 2025 Market Update: Rally amid Growth and Policy Shifts

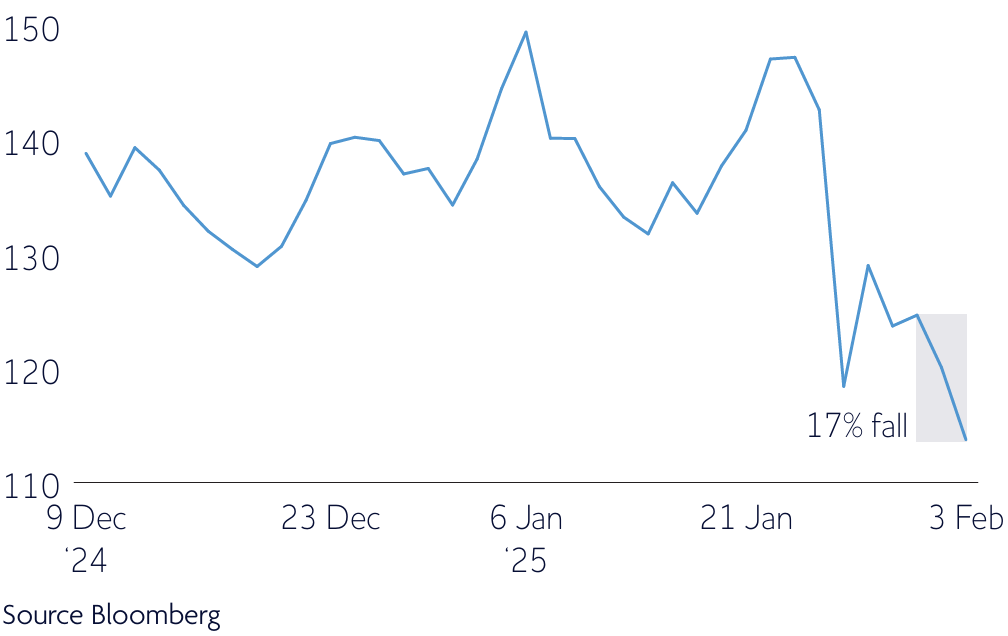

Nvidia’s share price (%) The chipmaker’s share price fell 17% after Chinese AI lab DeepSeek challenged Silicon Valley’s dominance.

Investors weigh inflation, rates and trade policies as markets adjust to shifting economic conditions

UK Stock Market on a High

London’s benchmark FTSE 100 index reached an all-time high after inflation dropped to 2.5%, potentially paving the way for several interest rate cuts this year. British stocks were also boosted by a drop in UK government bond yields after a spike in state borrowing costs sent the pound tumbling. At the beginning of January, UK bond yields climbed sharply before falling back following the publication of December’s inflation report. Global bond yields have surged, driven by a widespread sell-off that has intensified concerns over higher borrowing costs.

The UK economy returned to growth in November, expanding by just 0.1%. British retail sales also contracted in December, deepening fears about the economy. British pay growth remains strong but there are more signs of a weakening jobs market. Basic pay, excluding bonuses, rose by 5.6% in the three months to November, compared to 5.2% the previous month. The unemployment rate also rose to 4.4% from 4.3%.

Trump Raises Tariffs

Tech stocks were rattled by a new free Chinese artificial intelligence app called DeepSeek. US stocks also dipped and bond yields rose after jobs growth unexpectedly surged in December. Meanwhile, President Donald Trump’s inauguration had relatively little impact on markets. However, there are fears that Trump’s decision to raise tariffs on imports from Mexico, Canada and China could derail the economy’s momentum.

With inflation remaining elevated, the US Federal Reserve (Fed) kept interest rates on hold in January amid elevated inflation and uncertainty over Trump’s impact on the economy. US inflation rose again in December, reducing the chances the Fed will make major cuts this year. The headline rate picked up to 2.9% in December, up from 2.7% previously but in line with expectations. Financial markets are now anticipating two cuts from the Fed this year.

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

ECB Cuts Rates

The European Central Bank (ECB) cut interest rates for a fifth time since June to 2.75%, in a bid to boost the region’s f lagging economy. Euro area inflation climbed for a third consecutive month, reaching 2.4% in December from 2.2% the previous month. Meanwhile, the euro extended losses against the dollar, falling to its lowest level since September 2022.

The region’s economy ended 2024 with a slight contraction, weighed down by declines in business activity and employment. The fall in December was mainly due to a steep drop in manufacturing output, while services activity recovered. Employment also fell across euro area countries as firms cut workforce capacity.

China’s Markets Unsettled

President Trump’s threats of substantial tariffs on Chinese imports rattled the yuan, driving mainland bond yields down and causing share prices to dip. China’s consumer price inflation slipped to 0.1% in December, stoking deflation concerns. Consumption has failed to pick up despite Beijing’s attempts to boost growth. However, in a welcome boost for the world’s second-largest economy, China’s exports hit a record high in December, rising by 10.7% year-on-year.

Issued by Omnis Investments Limited. This update reflects Omnis and our investment management firms’ views at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information but no assurance or warranties are given. Past performance should not be considered as a guide to future performance. The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.