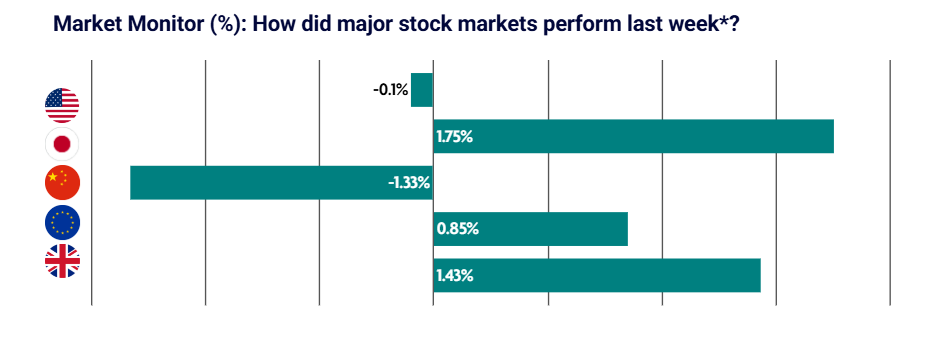

Global equity markets delivered mixed returns last week as investors continued to rotate away from technology stocks. Concerns around AI’s disruptive impact weighed on sentiment in the tech sector, though markets in Europe, the UK, and Japan all advanced despite this weakness.

US: Tech sector experiences worst week since November

U.S. equity markets ended the week mixed, with technology stocks posting their sharpest decline since November. Growing concerns around AI overinvestment and its disruptive effects weighed heavily on large-cap tech names.

The Nasdaq fell nearly 2%, while the S&P 500 finished broadly flat. In contrast, mid-cap and small-cap stocks recorded solid gains as investors rotated into sectors less exposed to AI-related risks.

Labour market data surprised to the downside. ADP payroll growth undershot expectations, job openings fell to their lowest level since 2020, and layoffs increased. However, manufacturing data showed improvement, with the ISM Manufacturing PMI reaching its highest level since 2022. Services activity remained in expansionary territory.

Overall, the week reflected a combination of tech-sector weakness, softening employment indicators, and pockets of resilience in the broader economy.

Japan: Equities rally on optimism surrounding upcoming election

Japanese equities posted strong gains, supported by optimism ahead of the 8 February election, where Prime Minister Sanae Takaichi’s Liberal Democratic Party was widely expected to secure a majority.

While global concerns about AI’s impact on software firms weighed slightly on sentiment, they did not prevent a broader market rally. The yen weakened as investors anticipated that a stronger political mandate could pave the way for further fiscal stimulus.

Takaichi initially described the weaker yen as supportive for exporters before later stressing the importance of broader economic resilience. Economic data showed a sharp decline in household spending, as inflation pressures continued to erode purchasing power. With living costs a central election issue, the government signalled further tax relief to support households.

China: Tech sector weakness and falling commodity volatility weigh on equities

Chinese equities declined over the week as weakness in the technology sector and falling commodity market volatility weighed on sentiment.

Private sector survey data pointed to modest improvement in economic activity in January. Services PMI rose to a three-month high, while manufacturing PMI expanded for a second consecutive month. However, official government PMI data painted a more subdued picture, highlighting continued challenges in boosting domestic consumption.

The divergence between private and official surveys reflects structural differences, with private PMIs more heavily weighted toward export-oriented firms. Economists continue to expect further monetary policy easing during 2026 to support growth.

Europe: Optimism around eurozone economy offsets global market volatility

European equity markets rose as optimism around the eurozone economy helped offset global volatility. Germany’s DAX gained 0.74%, Italy’s FTSE MIB rose 0.77%, and France’s CAC 40 Index advanced 1.81%.

The European Central Bank held interest rates steady for a fifth consecutive meeting, citing a resilient economy and inflation moving closer to its 2% target. January inflation slowed more than expected, with headline inflation falling to 1.7% and core inflation easing to its lowest level since 2021.

Retail sales declined slightly in December, though broader fourth-quarter data suggested stronger household spending. Investor sentiment improved as evidence mounted that inflationary pressures are continuing to ease across the region.

UK: Bank of England holds rates steady but near-term cuts expected

The Bank of England kept interest rates unchanged at 3.75% following a closely split vote, with four of nine policymakers favouring an immediate cut.

Markets interpreted the decision as a strong signal that rate reductions could begin as early as March. Governor Andrew Bailey stated that inflation is now expected to reach the 2% target by April—almost a year earlier than previously forecast—creating scope for policy easing.

Bailey also commented that market expectations for two interest rate cuts in 2026 were “reasonable.” Investors responded positively as the policy outlook shifted in a more dovish direction amid easing inflation pressures.