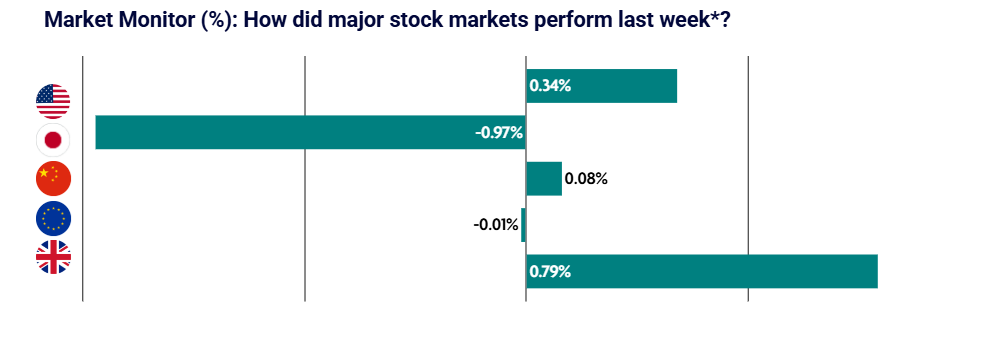

Global equity markets were mixed last week as investors reacted to the U.S. Federal Reserve’s latest policy meeting. UK equities were the standout performer, while Japanese markets lagged as a sharp rally in the yen weighed on sentiment.

US: S&P 500 briefly touches record highs before pulling back on softening investor sentiment

U.S. equities advanced during the week, with the S&P 500 briefly topping 7,000 for the first time before giving back some gains. Large-cap value stocks outperformed, while small and mid-cap shares lagged.

Economic data painted a mixed picture. Consumer confidence fell sharply to its weakest level since 2014, signalling softer sentiment around the economy and labour market. Jobless claims remained broadly unchanged, pointing to continued labour market resilience. Durable goods orders rebounded strongly in November, while producer prices rose more than expected, driven largely by services inflation.

The Federal Reserve held interest rates steady at 3.5%–3.75% following three consecutive cuts. Policymakers struck a more constructive tone on growth and highlighted stabilising unemployment. Fed Chair Jerome Powell reiterated a meeting-by-meeting approach to future decisions. Separately, President Trump nominated former Fed Governor Kevin Warsh to succeed Powell when his term ends in May.

Japan: Yen strength and AI spending concerns weigh on equities

Japanese equity markets ended the week lower, with the Nikkei 225 Index falling 0.97%. A strengthening yen weighed on export-oriented sectors, while concerns around spending on AI-related technology also pressured sentiment.

Political uncertainty ahead of the 8 February election drove sharp currency movements. The yen experienced significant volatility following Prime Minister Takaichi’s snap election announcement and debate around unfunded tax cuts. Rising speculation of potential currency intervention triggered a rapid appreciation against the U.S. dollar.

Although no direct intervention was confirmed, officials issued strong verbal guidance. Tokyo inflation eased to 2.0%, reducing expectations for further near-term interest rate hikes from the Bank of Japan.

China: Growth expectations lowered across several provinces

Mainland Chinese equity markets were broadly flat, while Hong Kong equities outperformed. Bloomberg reported that several provinces, including major coastal regions such as Guangdong and Zhejiang, lowered their 2026 GDP growth targets.

The revised targets point to more cautious local growth expectations amid uneven economic momentum, despite ongoing support for key industries.

Europe: Eurozone GDP growth beats expectations in 2025

European equity markets delivered mixed returns. Germany’s DAX fell 1.45% and France’s CAC 40 Index slipped 0.20%, while Italy’s FTSE MIB gained 1.55%.

The eurozone economy continued its gradual recovery, with GDP expanding by 1.5% in 2025—above the European Commission’s forecast of 1.3% and an improvement on 0.9% growth in 2024. Confidence improved across most sectors entering 2026, though it remains below long-term averages.

Germany trimmed its 2026 growth forecast to 1% from 1.3%, citing delays in policy implementation, though this still represents a notable improvement on the 0.2% growth recorded in 2025. Sweden’s Riksbank indicated that interest rates are likely to remain unchanged through at least 2026.

UK: All eyes on upcoming Bank of England meeting

UK equities outperformed, with the FTSE 100 rising 0.8% over the week. Investor attention is firmly on the Bank of England’s upcoming policy meeting on Thursday, 5 February, with markets widely expecting rates to remain unchanged at 3.75%.

Economic data suggested an improving productivity outlook. Economists have indicated that 2025 may have been one of the strongest years for UK productivity growth since 2008.

Housing indicators, however, remained weak. Mortgage approvals fell to an 18-month low in December, highlighting continued softness in housing demand despite improving sentiment in other parts of the economy.