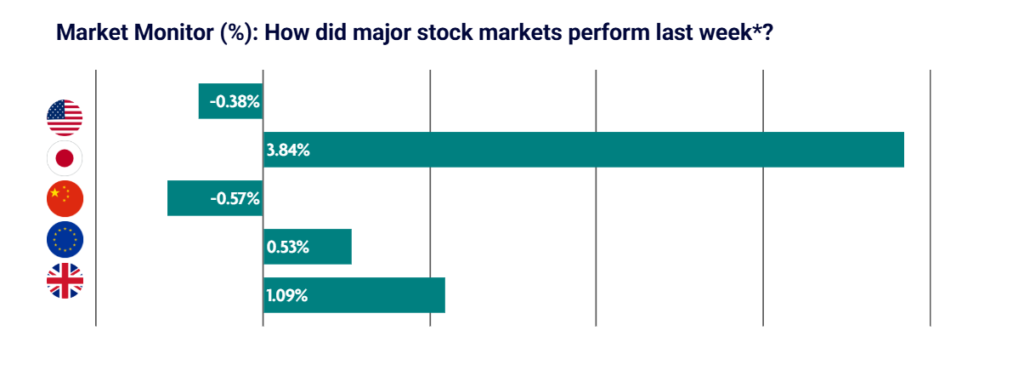

Global equity markets delivered mixed returns last week, as the rotation into smaller companies and value stocks continued. Japanese equities were the standout performer, rising sharply on growing expectations of a large government stimulus package.

US: Small companies and value stocks extend their year-to-date outperformance

U.S. equities were mixed over the week. Small-cap and value stocks continued to outperform, while large-cap indices eased back slightly from recent record highs.

Early earnings reports prompted mixed market reactions. Profits fell at some major banks but exceeded expectations at others, while strong results from Taiwan Semiconductor Manufacturing helped lift sentiment toward artificial intelligence-related stocks.

Political and trade developments added volatility. Headlines around proposed credit card interest rate caps, potential new tariffs, and news of an investigation involving Federal Reserve Chair Jerome Powell drew investor attention.

Inflation data showed core consumer prices rising 2.6%, the slowest pace since early 2021. Producer prices edged higher, driven by increased energy costs. Retail sales exceeded expectations, although the GDP-relevant control group pointed to slower underlying growth.

Japan: Economic stimulus hopes drive equities to near record levels

Japanese equities surged to near record highs as speculation grew that Prime Minister Sanae Takaichi may call a snap election, potentially delivering a stronger mandate and enabling a larger fiscal stimulus package.

Sectors linked to artificial intelligence, nuclear energy, and defence benefited most. The yen weakened briefly on the election news before stabilising, supported by comments from the finance minister indicating readiness to counter excessive currency movements.

Government bond yields rose amid concerns that increased stimulus could strain public finances. Speculation also emerged that the Bank of Japan may raise interest rates earlier than previously expected due to ongoing yen weakness. However, officials reiterated that any tightening would depend on economic conditions and the sustainability of wage growth.

China: Stocks ease as regulators tighten investment financing rules

Mainland Chinese equities fell after regulators tightened investment financing rules. Investors are now required to provide collateral equal to the full value of credit-funded stock purchases, a move aimed at cooling rapid market gains following a sharp rally driven by artificial intelligence themes and optimism around domestic technology firms.

Authorities became increasingly cautious as investment borrowing approached record levels and the CSI 300 reached a four-year high earlier in the month.

Economic data showed exports jumped at their fastest pace in three months in December, lifting China’s 2025 trade surplus to a record USD 1.2 trillion. Strong shipments to Southeast Asia and Europe more than offset tariff-related declines in exports to the United States.

Europe: EU countries endorse largest ever free trade agreement

European equity markets were mixed. Germany’s DAX and Italy’s FTSE MIB posted modest gains, while France’s CAC 40 Index fell 1.2%.

Germany’s economy grew for the first time in three years in 2025, supported by increased household and government spending. Official data showed GDP expanded by 0.2% in the fourth quarter and across the full year.

Investor sentiment improved sharply in January, reaching its strongest level since July 2025, according to market research firm Sentix.

After 25 years of negotiations, European Union countries provisionally endorsed a free trade agreement with South America’s Mercosur bloc, which includes Argentina, Bolivia, Brazil, Paraguay, and Uruguay. The deal—the EU’s largest ever in terms of tariff reductions—will see tariffs gradually eliminated on more than 90% of bilateral trade.

UK: Equities rise on better-than-expected economic growth

UK equities strengthened over the week as economic data pointed to a return to growth.

UK GDP rose 0.3% in November after contracting in the previous two months, beating expectations for a 0.1% increase. Growth was supported by gains in both services and production, with manufacturing boosted in part by Jaguar Land Rover restarting operations following a cyberattack.

UK borrowing costs fell to their lowest level in a year, supported by growing expectations of further interest rate cuts and easing concerns around elevated government borrowing.