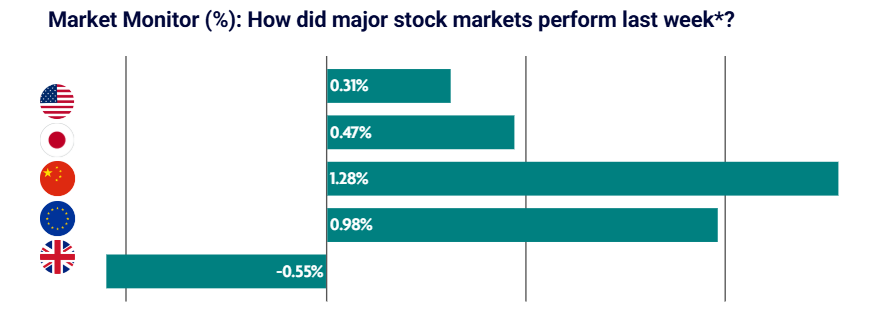

Global equities advanced as expectations for a December U.S. interest rate cut supported risk appetite. Chinese equities outperformed, with investors overlooking weak economic data in favour of the stronger long-term outlook for domestic technology and AI.

US: Stocks rise in anticipation of a 0.25% interest rate cut this week

U.S. equity markets ended the week higher as investors priced in an increasing likelihood of an interest rate cut at this week’s Federal Reserve meeting.

The Nasdaq Composite led gains (+0.91%), followed closely by the small-cap Russell 2000 Index (+0.84%).

Economic data painted a mixed picture:

- Manufacturing activity contracted for the ninth consecutive month (ISM data)

- Services activity expanded at the fastest pace since February

- Private payrolls fell by 32,000 in November (ADP), the biggest drop since March 2023

- The PCE inflation measure rose 0.3% month over month, implying a 2.8% year-over-year increase

Despite some signs of softening, markets remained confident that a December rate cut is likely.

Japan: December interest rate hike in Japan on the agenda

Japanese equities were mixed as comments from Bank of Japan Governor Kazuo Ueda increased expectations of a possible December interest rate hike.

Bond yields reacted swiftly, climbing to 1.93%—the highest level since 2007.

Household spending contracted sharply, falling 3.0% year on year in October, compared with expectations for a 1.0% increase. This marked the steepest drop since January 2024 and followed a gain of 1.8% in September.

China: Stocks rally despite worsening economic data

Mainland Chinese equities rose strongly as investor enthusiasm for domestic technology and AI outweighed signs of slowing economic activity.

Economic indicators continued to weaken:

- Official manufacturing PMI remained in contraction at 49.2

- November marked the eighth consecutive month below 50—a record-long downturn

- Non-manufacturing PMI fell to 49.5, signalling the first contraction in nearly three years

- Weakness was most pronounced in construction and residential services

Despite the data, sentiment in China’s tech and AI sectors continued to drive market gains.

Europe: European equities advance on expectations of U.S. and UK interest rate cuts

European equity markets produced mixed but generally positive results. Germany’s DAX gained 0.80%, Italy’s FTSE MIB rose 0.17%, while France’s CAC 40 fell slightly.

Eurozone inflation ticked up to 2.2% in November—slightly above expectations but close to the ECB’s 2% target.

GDP growth for the third quarter was revised upward to 0.3%, supported by stronger fixed investment. France and Spain contributed to the growth, while Germany stagnated.

Eurozone unemployment remained steady at 6.4% in November.

UK: Pound rises to highest level since October on stronger economic activity

UK equities fell slightly for the week, giving back gains made previously.

Sterling strengthened sharply—marking its biggest daily rise since April—after stronger domestic activity data prompted traders to unwind negative bets on the currency.

UK housing remained resilient:

- Nationwide’s house price index rose 0.3% month on month, above expectations

- Mortgage demand remained steady, with approvals at 65,018 in October, down only slightly from 65,647 in September

Stronger-than-expected economic indicators supported sentiment, even as markets awaited further clarity on interest rate policy.