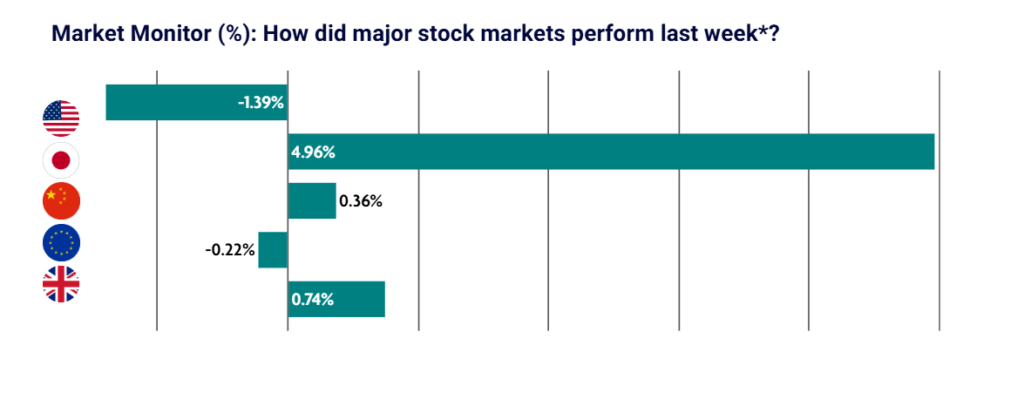

AI disruption concerns once again dominated global markets, with U.S. equities lagging international peers. Japan was the standout performer, rallying strongly after the Liberal Democratic Party secured a supermajority in the recent election.

US: Tech sector sell-off intensifies while jobs data surprises to the upside

U.S. equities declined over the week as concerns about widespread AI disruption continued to pressure technology stocks. The tech-heavy Nasdaq was hit hardest, while value stocks outperformed growth stocks for the seventh consecutive week. Year-to-date, value stocks now lead growth by 11%.

January employment data surprised to the upside, with 130,000 new jobs added and the unemployment rate falling to 4.3%. Stronger labour market data reduced expectations for near-term Federal Reserve rate cuts, with markets now anticipating policy to remain unchanged through June.

Inflation cooled slightly, with headline CPI rising 0.2% month on month, although core inflation ticked higher. Retail sales were flat, missing expectations. U.S. Treasury bonds gained as yields fell, partly supported by weakness in technology shares.

Japan: Equities jump on Liberal Democratic Party supermajority

Japanese equities rallied strongly after the Liberal Democratic Party secured a supermajority, strengthening Prime Minister Sanae Takaichi’s mandate for expansive fiscal policy, investment initiatives, and potential constitutional reform on defence.

The yen appreciated following government verbal intervention aimed at stabilising currency movements. Economic data showed real wages falling 0.1% year over year in December, disappointing expectations as inflation continues to pressure household incomes.

China: Stocks gain slightly ahead of Lunar New Year holidays

Chinese equities ended the week modestly higher ahead of the Lunar New Year holidays, with mainland markets closed from 16 February to 23 February.

Inflation data showed easing consumer price pressures, with CPI rising 0.2% year over year in January, down from 0.8%. Producer prices remained in deflation for a 40th consecutive month, falling 1.4%.

The property sector showed tentative signs of stabilisation. The decline in second-hand home prices slowed, while new home prices fell at a similar pace to the previous month. The People’s Bank of China reiterated its commitment to a moderately loose policy stance in 2026, signalling support for domestic demand and technological innovation.

Europe: Volatile week ends slightly lower as markets digest U.S. jobs data and AI disruption concerns

European equities ended a volatile week slightly lower overall. Germany’s DAX rose 0.78%, Italy’s FTSE MIB declined 0.97%, and France’s CAC 40 gained 0.46%.

Markets reacted to stronger-than-expected U.S. jobs data and renewed concerns about AI-related disruption. Within the eurozone, fourth-quarter GDP expanded 0.3%, with annual growth at 1.5%, led by Spain.

Employment rose more than expected across the region, although Germany saw a slight contraction. France’s unemployment rate rose to its highest level since 2021, with youth unemployment particularly elevated. In Germany, wholesale prices increased 1.2% year over year, driven by higher metals and food prices.

UK: Retail sales rise at fastest pace since August

UK investor sentiment was initially weighed down by political uncertainty following calls for Prime Minister Keir Starmer to resign over his appointment of Lord Mandelson as U.S. ambassador.

Economic data showed modest fourth-quarter GDP growth of 0.1%, with output 1% higher than a year earlier. Manufacturing expanded while construction contracted.

Retail sales offered a more positive signal, rising 2.3% year over year in January, the fastest pace since August. Bank of England Chief Economist Huw Pill commented that disinflation is ongoing but less convincing than policymakers had hoped 18 months ago, urging caution regarding further interest rate cuts.