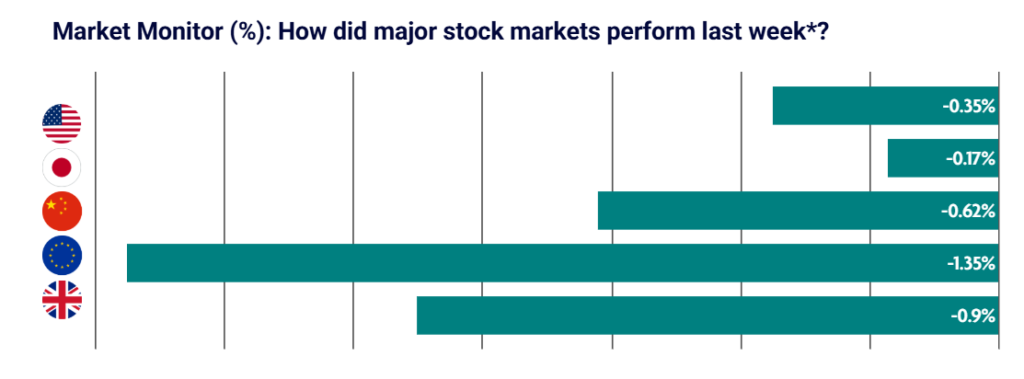

Global equity markets declined last week amid elevated geopolitical and trade-related uncertainty. However, stocks recovered from their lows after President Trump once again shifted his stance, helping to restore some investor confidence by the end of the week.

US: Equity markets end volatile week modestly lower

U.S. equity markets finished a volatile and shortened week modestly lower. Stocks recorded their largest daily fall since October after President Trump announced plans to impose tariffs on European countries opposing U.S. efforts to acquire Greenland.

Market sentiment improved later in the week following a public shift in tone from President Trump, allowing equities to recover part of their earlier losses.

Economic data was broadly supportive. Third-quarter GDP growth was revised higher to an annualised rate of 4.4%, up from 3.8%, driven by strong exports and business investment. The Bureau of Economic Analysis also reported that the core personal consumption expenditures (PCE) price index rose 0.2% in November, in line with October’s reading. On a year-on-year basis, core PCE inflation stood at 2.8%, remaining above the Federal Reserve’s long-term 2% target.

Labour market data continued to signal resilience, with jobless claims remaining low. Consumer sentiment improved from December, although it stayed well below levels seen a year earlier.

Japan: Domestic political uncertainty weighs on markets

Japanese equities declined as domestic political developments unsettled investors. The announcement of an early election, alongside proposals for a temporary cut to food consumption taxes, raised concerns about fiscal discipline and how any resulting revenue shortfall would be funded.

The Bank of Japan kept its policy stance unchanged and reiterated that future policy adjustments would depend on economic conditions. Updated forecasts pointed to stronger growth and higher inflation over the medium term.

Overall, market sentiment in Japan remained cautious amid ongoing political and policy uncertainty.

China: Growth target met in 2025, but signs of slowing emerge

Chinese equity markets were mixed as new data highlighted uneven economic conditions. Official figures showed economic growth slowed to 4.5% in the fourth quarter, while full-year growth of 5% met the government’s target for a third consecutive year.

Industrial output improved toward the end of the year, supported by external demand, but consumer activity remained subdued. Fixed asset investment declined over the year, reflecting weak domestic confidence, while retail sales growth lagged expectations, marking one of the slowest readings since reopening.

Analysts cautioned that maintaining current growth rates could prove challenging as global protectionism increases and base effects become less supportive.

Europe: Heightened geopolitical and trade uncertainty puts equities under pressure

European equity markets declined amid renewed geopolitical and trade uncertainty. France’s CAC 40 fell 1.40%, Germany’s DAX lost 1.57%, and Italy’s FTSE MIB dropped 2.11%.

Business surveys indicated that eurozone activity continued to expand modestly in January, supported by improving new orders and rising confidence. Business optimism reached its highest level in nearly two years despite ongoing external risks.

Political developments also weighed on sentiment, including delays surrounding the EU trade agreement with Mercosur. Overall, Europe showed signs of cautious economic progress alongside elevated uncertainty.

UK: Labour market continues to soften

The UK labour market showed further signs of softening, with unemployment remaining at a multi-year high and job losses concentrated in consumer-facing sectors. Wage growth continued to slow, including in the private sector, easing some cost pressures on businesses.

Consumer activity showed tentative improvement, with retail sales volumes rising in December after two weak months. Inflation, however, accelerated unexpectedly, driven by higher travel and tobacco costs, although policymakers continue to expect inflation to slow toward 2% by April or May.

Business surveys pointed to improved momentum entering the new year, highlighting a fragile but gradually stabilising economic backdrop.