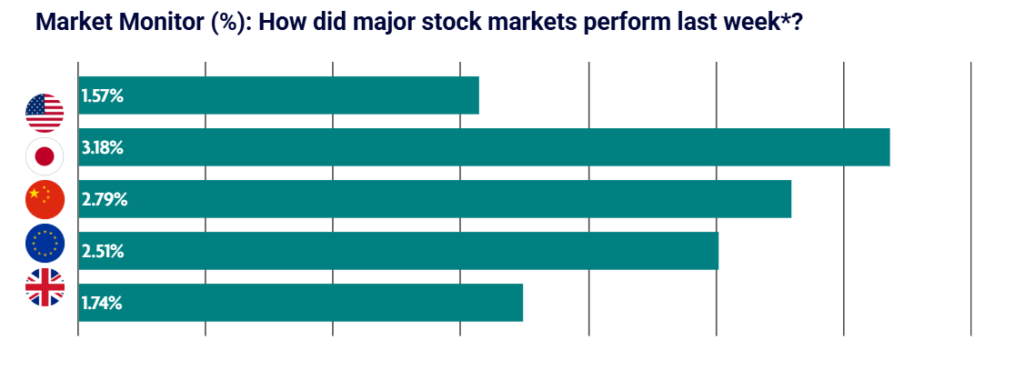

Global equities rallied in the first full week of trading for 2026, as investors largely looked through rising geopolitical tensions. Japanese equities led the gains, while U.S. markets saw a broadening of the rally beyond the large-cap growth stocks that have dominated in recent years.

US: Equities rally as investors look past mounting geopolitical tensions

U.S. equity markets advanced, with small-cap and value stocks outperforming large-cap growth shares. This marked a notable shift after several years in which returns were dominated by a narrow group of growth stocks.

Aerospace and defence stocks were volatile during the week. Shares initially fell following comments from President Trump suggesting restrictions on dividends and share buybacks unless production of military hardware was accelerated. However, defence stocks rebounded the following day after the administration proposed a substantial increase in military spending.

Labour market data surprised to the downside. Job growth moderated in December, and previous months’ figures were revised lower. Despite this, the unemployment rate edged down to 4.4% from a revised 4.5% in November.

Manufacturing activity continued to struggle. ISM Manufacturing PMI fell to 47.9 in December, the lowest reading of 2025 and the tenth consecutive month of contraction. In contrast, services activity expanded for the tenth straight month, with gains in new orders, business activity, and employment pushing the Services PMI to its highest level of the year.

Japan: Equities rally on government stimulus hopes

Japanese equities posted strong gains as optimism around government stimulus outweighed geopolitical tensions between China and Japan.

Technology stocks continued to perform well, while a weaker yen supported export-oriented companies and trading houses. The yen depreciated as investors grew concerned about the scale of government spending plans aimed at stimulating economic growth.

Bank of Japan Governor Kazuo Ueda reiterated that the central bank will continue raising interest rates in line with improvements in economic conditions and inflation. He added that the relationship between moderate wage growth and inflation is likely to remain intact.

China: Domestic tech optimism drives equities to four-year highs

Chinese equities climbed to four-year highs during the week, driven by strong enthusiasm for domestic technology and artificial intelligence stocks.

Margin lending increased sharply, with outstanding loans used to purchase equities nearing record levels, according to Bloomberg. Inflation data showed a modest pickup in consumer prices, while producer prices remained under pressure.

China’s consumer price index rose 0.8% year on year in December, in line with forecasts. Meanwhile, the producer price index fell 1.9%, marking the 39th consecutive month of declines but the smallest decrease in more than a year.

Europe: Stocks rally on optimism around the economic outlook

European equity markets rose on signs that economic conditions may be improving toward the end of 2025.

Germany’s DAX gained 2.94%, France’s CAC 40 Index rose 2.04%, and Italy’s FTSE MIB added 0.76%. Industrial production data from Germany, France, and Spain exceeded expectations in November, with German output rising 0.8% month on month rather than the forecast 0.5% decline.

Eurozone headline inflation slowed to 2.0% in December, aligning with the European Central Bank’s target. However, some economists noted that services inflation remains more persistent, which could continue to concern policymakers.

UK: Equities rally on expectations for further interest rate cuts in 2026

UK equities rose on growing expectations that the Bank of England could deliver two further interest rate cuts in 2026.

The UK 10-year government bond yield recorded its largest weekly decline since April, providing support to equity markets. Resource stocks also advanced amid reports of potential merger talks between Rio Tinto and Glencore.

Housing data was mixed. Mortgage approvals for house purchases fell slightly to 64,530 in November from 65,010 in October. Halifax reported that house prices unexpectedly declined by 0.6% in December, following a 0.1% fall in November, as economic and tax uncertainty weighed on sentiment at the end of the year.