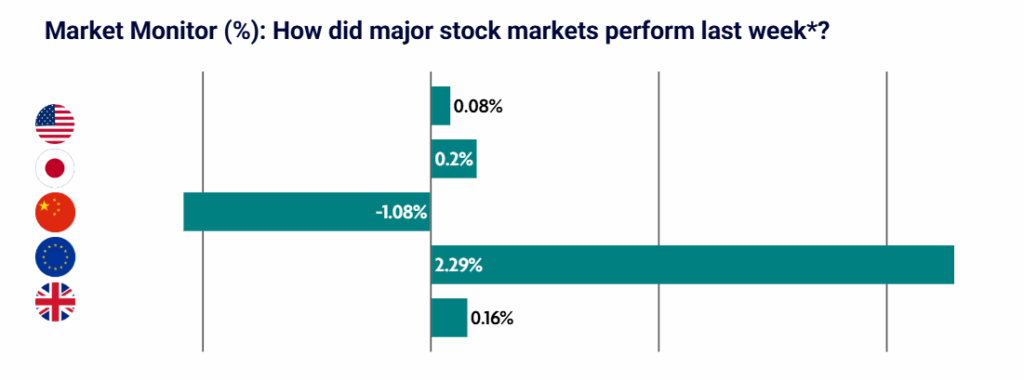

A largely muted week for global equities, despite a significant number of headlines. Investor sentiment was broadly supported by the end of the US government shutdown, however, economic growth concerns and valuation concerns in the artificial intelligence space provided something for both the bulls and the bears. European equities were the standout performer, while Chinese equities lagged.

US: Hawkish commentary from Federal Reserve officials and valuation concerns see AI stocks selloff

U.S. equity markets ended the week with mixed results. The S&P 500 was largely flat, while the Nasdaq, S&P MidCap 400, and Russell 2000 pulled back. The week was marked by a rotation out of high-growth tech stocks, especially those tied to artificial intelligence, as investors grew concerned surrounding lofty valuations and potential regulatory scrutiny. The longest U.S. government shutdown on record ended on Wednesday evening after President Donald Trump signed a spending bill that will keep the government funded through to 30 January 2026. Atlanta Federal Reserve President Raphael Bostic outlined concerns over ambiguous labour market data, highlighting we are unlikely to see aggressive rate cuts amid persistent inflation. Two other Federal Reserve officials echoed similar caution, which saw the chance of a December rate cut fall to 46%, down from 95% a month ago.

JAPAN: Equities rise slightly on improving investor sentiment

Japanese equities rose slightly for the week, as global sentiment was supported by the U.S. ending the country’s longest government shutdown in history. Conversely, continued concerns about overstretched valuations of companies with revenue streams linked to artificial intelligence weighed on Japan’s technology sector. Meanwhile, expectations of more loose fiscal policy and caution surrounding further interest rate rises under new Prime Minister Sanae Taikachi pressured the yen. She shared her concept that responsible, yet aggressive, fiscal spending is required to boost economic growth.

CHINA: Stocks pullback from record high on slowing growth concerns

Chinese equities rose for the week, helped by easing trade tensions with the U.S. The positive momentum followed a meeting between U.S. and Chinese leaders at the APEC summit in South Korea, where both sides agreed to a one-year truce in their trade dispute. Although the meeting produced few concrete policy outcomes, markets took the handshake agreement as a sign that both nations are seeking stability as opposed to a continued escalation of tensions. Analysts noted that while competition between the two powers will remain a defining long-term theme, near-term de-escalation has buoyed sentiment and lifted risk appetite. The CSI 300 Index is now trading near a four-year high, highlighting renewed optimism toward Chinese equities.

EUROPE: Valuation concerns, weak economic data and softer sentiment sess European equities ease

European markets fell for the week, driven by weakness in AI-related stocks and persistent valuation concerns weighing on investor risk appetite. Both Sweden’s and Norway’s central banks kept interest rates unchanged, signalling that rates will likely stay higher for longer as inflation pressures remain stubborn. Eurozone retail sales contracted for a third straight month in September, highlighting subdued consumer spending. In Germany, industrial production rose just 1.3%, which was below expectations, while new orders increased slightly but remained weak overall. The German economy ministry described manufacturing activity as “still fragile,” highlighting ongoing headwinds from weak global demand and high energy costs.

UK: Interest rates held steady, but outlook for near-term cuts becomes clearer

UK equities eased slightly for the week, with the FTSE 100 retreating -0.36%. Monetary policy was the key focus for investors. The Bank of England held interest rates steady at 4%, as widely expected, although Governor Andrew Bailey hinted that a rate cut could be on the horizon as soon as December. Five members voted to hold the key interest rate, while four opted for a 0.25 percent cut. Governor Bailey commented that market expectations for a gradual decline in rates over the next three years was “a fair description” of his outlook. CNBC reported that economists are now pricing in a pre-Christmas rate cut. This saw the UK market hold up better than European peers.