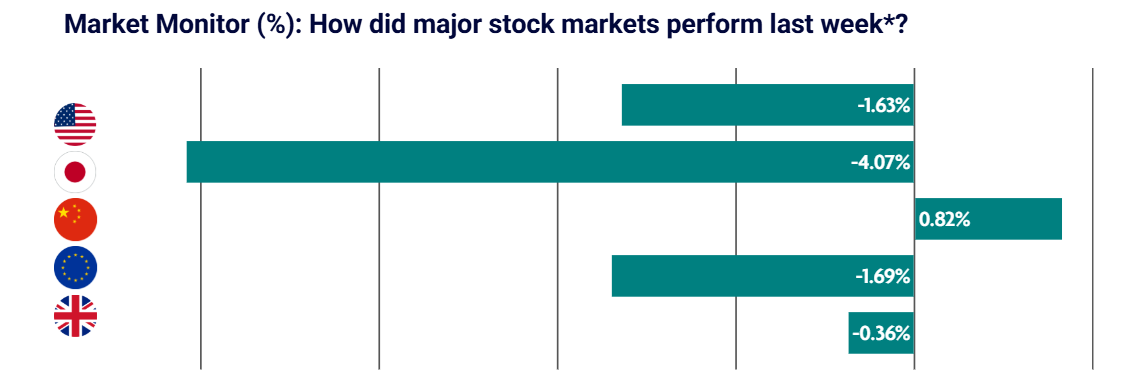

Global equities pullback amid widespread selling across mega-cap Tech and AI-exposed companies. Chinese equities proved resilient, while the Bank of England held interest rates steady, as widely expected.

US: AI stocks pullback amid concerns over stretched valuations and spending

U.S. stocks ended a three-week winning streak as a sell-off in technology shares dragged major indices lower, driven by concerns over lofty valuations and scrutiny of AI-related spending. Growth stocks underperformed value shares by the widest margin since February. The ongoing federal government shutdown, which is the longest on record, further dampened sentiment as worries grew about its economic impact and delays in government data. Meanwhile, a report released by consulting firm Challenger, Gray & Christmas indicated October layoffs hit their highest level since 2003. Other economic data painted a mixed picture, with services activity returning to expansion, manufacturing contracting for the eighth month in a row, and consumer sentiment falling to its lowest level since 2022, predominantly driven by the government shutdown.

JAPAN: Stocks pullback sharply, driven by selling in AI and semiconductor stocks

Japanese equities retreated from record highs, with the Nikkei 225 down 4.07%, as investors took profits in AI and chip-related stocks amid valuation concerns. Broader risk aversion supported the yen, which strengthened slightly against the U.S. dollar as officials reiterated close monitoring of currency movements. Risk aversion supported the yen, which strengthened slightly against the U.S. dollar as Finance Minister Satsuki Katayama reiterated that authorities are monitoring foreign exchange movements “with a high level of urgency.” Wage data showed real wages (or wages adjusted for inflation) fell for a ninth consecutive month, suggesting inflation is still eroding household purchasing power. Prime Minister Sanae Takaichi reaffirmed her commitment to boosting domestic demand, saying Japan has yet to achieve sustainable price and wage growth. Her government is expected to unveil a fiscal stimulus package later this month to support consumer spending and shore up confidence.

CHINA: Stocks rally on easing trade tensions and improving investor sentiment

Chinese equities rose for the week, helped by easing trade tensions with the U.S. The positive momentum followed a meeting between U.S. and Chinese leaders at the APEC summit in South Korea, where both sides agreed to a one-year truce in their trade dispute. Although the meeting produced few concrete policy outcomes, markets took the handshake agreement as a sign that both nations are seeking stability as opposed to a continued escalation of tensions. Analysts noted that while competition between the two powers will remain a defining long-term theme, near-term de-escalation has buoyed sentiment and lifted risk appetite. The CSI 300 Index is now trading near a four-year high, highlighting renewed optimism toward Chinese equities.

UK: Interest rates held steady, but outlook for near-term cuts becomes clearer