Financial planning for busy professionals and families

Whether you’re building wealth, protecting your family, or planning for retirement, we help you make confident financial decisions. Many of our clients are local professionals working in tech, balancing careers with family life, we provide clarity and peace of mind for the road ahead.

Families

Plan ahead for education costs, mortgages and family protection insurance.

Professionals

Make the most of employer share schemes, ISAs and retirement pensions.

Retirement

Secure your lifestyle with pension drawdown, investments and estate planning.

Investments – The value of investments and any income from them can fall as well as rise and you may not get back the original amount invested.

IHT/Tax Planning/Estate Planning – Tax advice is not regulated by the Financial Conduct Authority.

Mortgages – Your home may be repossessed if you do not keep up repayments on your mortgage.

How we can help you

We offer clear, independent advice across all areas of financial planning, from mortgages to pensions. Whatever your goals, we’ll help you make confident decisions about your future.

We dig deep into your current strategies to ensure every pound is working its hardest. Our tailored independent advice ensures your investments align with your life goals, not just market trends.

The value of investments, and any income from them, can fall as well as rise and you may not get back the original amount invested.

Planning for retirement shouldn’t be daunting. We’re here to guide you every step of the way, ensuring you’re saving enough to retire when you want and how you want. Together, we’ll create a clear, achievable path to your dream retirement.

Balancing the present with the future is no easy task. We help you strike the perfect balance between saving and investing, so you can enjoy life now while building your wealth for tomorrow.

Investments – The value of investments and any income from them can fall as well as rise and you may not get back the original amount invested.

From income to capital gains and inheritance taxes, we develop strategies to minimise their impact, allowing you to keep more of your money.

IHT/Tax Planning/Estate Planning – Tax advice is not regulated by the Financial Conduct Authority.

Protecting what you’ve built is just as important as growing it. Our bespoke and independent insurance solutions offer peace of mind, ensuring that your assets and loved ones are safeguarded against life’s uncertainties.

Whether you’re buying your first home, moving, or refinancing, we provide clear, tailored advice to help you make confident, informed decisions. Our advice ensures your mortgage works seamlessly with your financial goals, paving the way to long-term security

Please note your home may be repossessed if you do not keep up repayments on your mortgage.

Ready to take the next step?

Book a free, no-obligation chat and see how financial planning can give you clarity and confidence about the future.

Why Albon Financial Planning?

We believe financial planning should be clear, personal and focused on what matters most to you. Here’s what makes us different:

Independent & Regulated

FCA authorised and part of the 2plan Wealth Management network, giving you peace of mind and security.

Real World Experience

With over 10 years' experience at Amazon and Microsoft, we understand the financial challenges facing today's professionals.

Future Focused

We use smart technology to deliver advice efficiently - giving you more clarity, and us more time to focus on what matters: you.

Latest Insights

Stay informed with our latest updates, guides and financial planning insights.

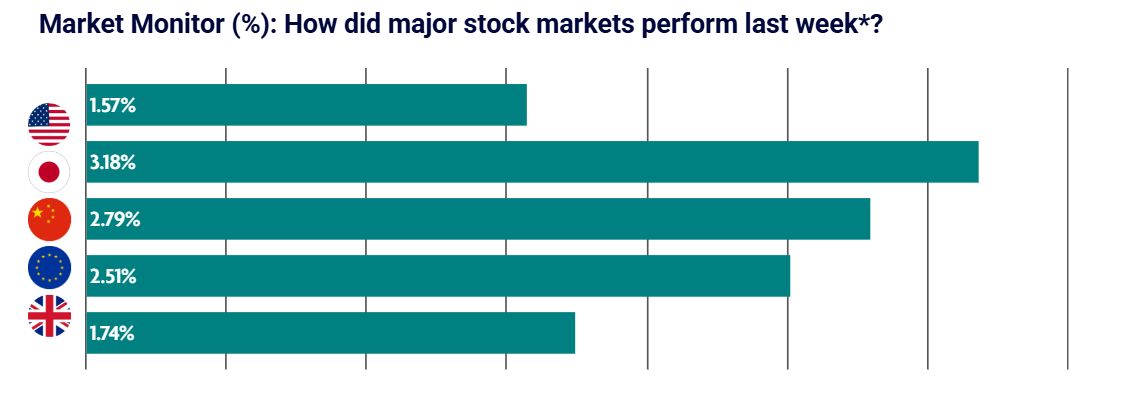

Weekly Market Update – 12th January 2026: Global Equities Rally as 2026 Gets Underway

Global equities rallied in the first full week of trading for 2026, as investors largely looked through rising geopolitical tensions. Japanese equities led the gains,…

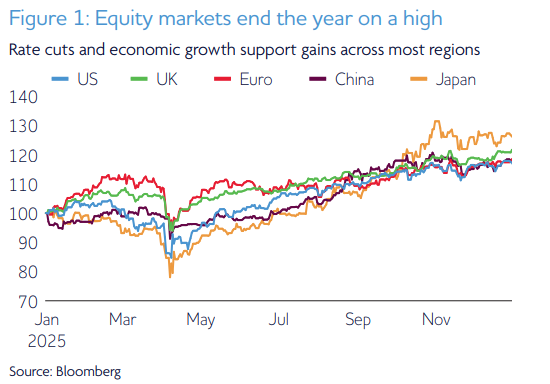

Stock markets end 2025 on a high

January 2026 | Market update Equity markets closed the year strongly as investors looked past tariff turmoil Equities shrug off uncertainty. Markets finished the year…

Timeline Tracker Portfolio Update: Lower Costs and Smarter Diversification

This Timeline Tracker portfolio update explains the January 2026 changes, including lower fees, improved diversification and what it means for long-term investors.

Ready to take the next step?

Book a free, no-obligation chat and see how financial planning can give you clarity and confidence about the future.